Best Starter Card for Points & Miles

If you’re just starting your travel rewards journey, the world of points and miles can feel overwhelming.

With dozens of credit cards, hundreds of airlines and hotels, and seemingly endless categories, it’s easy to freeze up at the thought of committing to a card.

The good news? You don’t need to sign up for a dozen cards to get started. There are a few beginner-friendly cards with low annual fees that give you serious value right away. Today, we’re breaking down three excellent options:

Chase Sapphire Preferred® ($95)

Capital One Venture ($95)

Citi Strata Premier ($95)

Each card has its strengths, and I’ll walk you through the perks, earning potential, and why each could be a great first card.

Why Starter Cards Matter

Before diving into the cards themselves, let’s talk about why these $95 cards are so powerful for beginners:

Low Annual Fee: You’re not committing hundreds of dollars per year while you figure out how points work.

High Value Sign-Up Bonuses: Most cards offer tens of thousands of points upfront, which can often cover your first flight or hotel stay.

Beginner-Friendly Rewards: These cards have simple earning structures and perks that are easy to understand.

Think of these cards as your training wheels—they give you a taste of travel hacking without overwhelming you with complex rules or high fees.

Chase Sapphire Preferred® (CSP)

Annual Fee: $95

The Chase Sapphire Preferred is my personal favorite for beginners. It’s versatile, beginner-friendly, and offers several perks that offset the fee.

Key Benefits:

Welcome Bonus: 75,000 points after spending $5,000 in the first 3 months (worth $900+ in travel through Chase Ultimate Rewards®).

Earning Rates:

5x points on travel purchased through Chase Travel

3x points on dining, select streaming services, and online grocery purchases

2x points on other travel purchases

1x point on all other purchases

Credits & Perks:

$50 annual hotel credit via Chase Travel

$10/month DoorDash credit ($120/year)

10% anniversary points bonus

Travel Protections: Trip cancellation/interruption, primary rental car insurance, and purchase protection

Sign up bonuses can change over time. View current offer here.

Why CSP Works for Beginners

CSP gives you flexibility and value. The bonus alone can cover multiple short flights or a hotel stay. Add in the DoorDash credit, hotel credit, and anniversary points bonus, and the effective cost of the card can actually be negative if you use the perks.

For example:

Annual fee: $95

Credits used: $50 hotel + $120 DoorDash = $170

Effective cost: $95 – $170 = -$75

Even if you don’t maximize the credits, the points themselves are more than worth the annual fee.

Capital One Venture ($95)

Annual Fee: $95

The Capital One Venture is another strong option for beginners. Unlike CSP, it doesn’t have many ongoing credits, but it’s super simple: earn flat-rate miles on everything, redeemable for any travel.

Key Benefits:

Welcome Bonus: 75,000 miles after spending $4,000 in the first 3 months

Earning Rates: 2x miles on all purchases

Travel Protections: Trip cancellation/interruption insurance, auto rental collision damage waiver, purchase protection

Why Venture Works for Beginners

The beauty of the Venture is simplicity. You earn 2 miles per dollar on everything, and you can redeem miles for any travel purchase—even flights that don’t have award availability.

Think of it as “plug-and-play” rewards. You don’t have to worry about categories, portals, or transfer partners. The Venture is a solid choice if you want low-stress rewards that are flexible.

Citi Strata Premier ($95)

Annual Fee: $95

The Citi Strata Premier is a newer option that balances travel perks with category-based rewards.

Key Benefits:

Welcome Bonus: 60,000 points after spending $4,000 in the first 3 months

Earning Rates:

3x points on travel (hotels, flights, taxis/rideshares), dining, supermarkets, gas stations, and EV charging

1x point on all other purchases

Credits & Perks: $100 annual hotel savings via Citi Travel

Additional Perks: Access to Citi Entertainment, purchase protection, and extended warranty

Why Strata Premier Works for Beginners

Strata Premier gives you category bonuses on everyday spending, which makes it easier to rack up points quickly. If you frequently spend on dining, groceries, or gas, the 3x points can add up fast. The $100 hotel savings credit is a nice little perk to offset the annual fee.

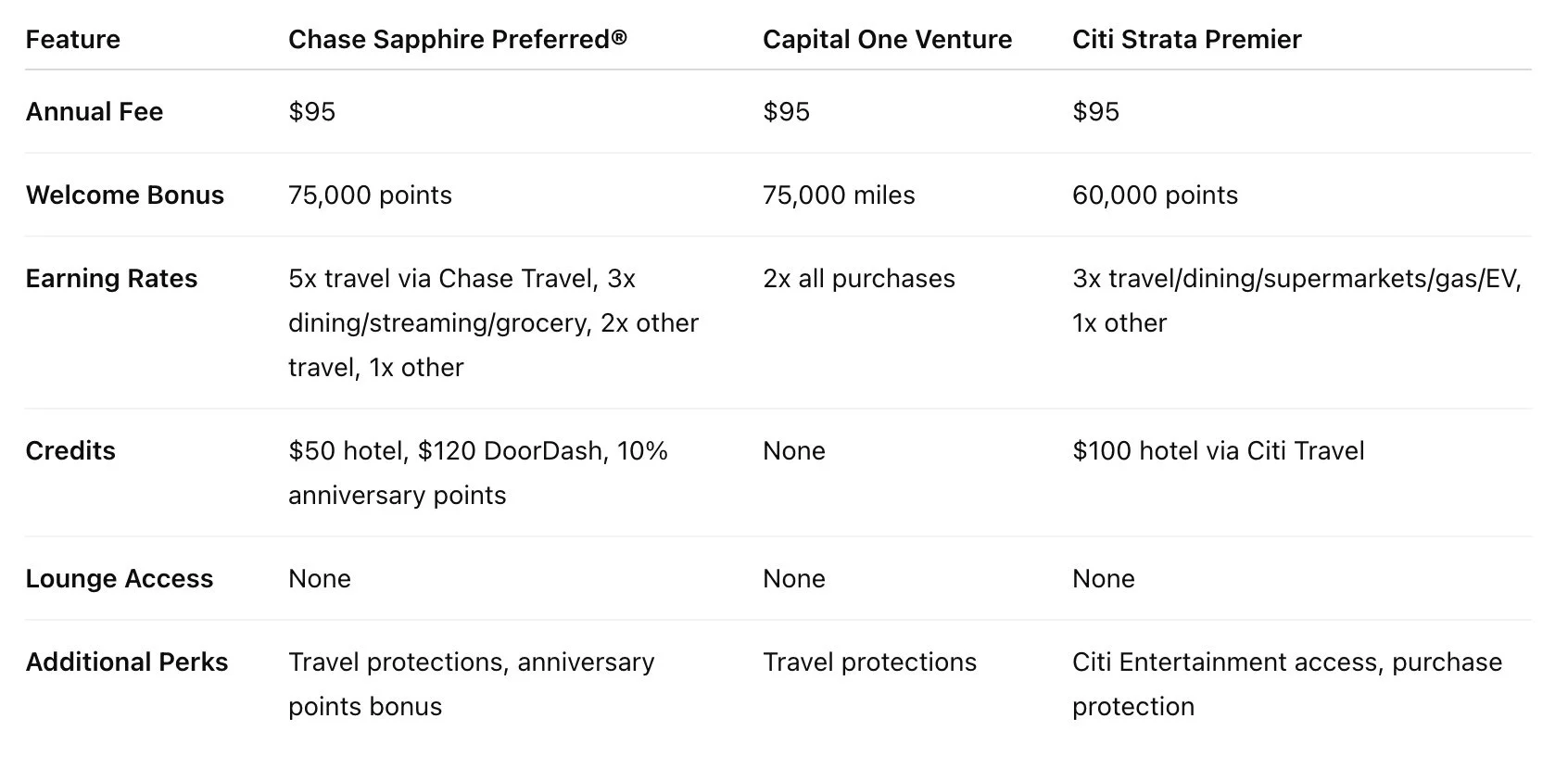

Side-By-Side Comparison

How to Choose the Right Card for You

Here’s a simple guide:

Want flexibility + strong bonus + extra perks? → Chase Sapphire Preferred

Want simplicity and flat-rate rewards? → Capital One Venture

Want higher rewards on everyday categories + hotel credit? → Citi Strata Premier

Also, take a look at these bank’s transfer partners and determine which partners you would transfer your points to the most.

Remember: the annual fee is just a number. Even $95 can be worth it if you maximize your sign-up bonus and perks. Ask yourself: would you spend $95 to save $1,000+ on travel? The math says yes.

Beginner Tips to Maximize These Cards

Always hit the minimum spend for the sign-up bonus. That’s where most of your first-year value comes from.

Use credits and perks early so you don’t leave value on the table.

Consider your spending habits when choosing: CSP rewards dining and travel, Venture rewards everything evenly, Strata Premier rewards specific everyday categories.

Track your points and redemptions. Even beginner-friendly cards are easier to manage if you see the rewards adding up.

Final Thoughts

If you’re new to travel hacking, any of these $95 cards can be a powerful first step. My personal favorite is Chase Sapphire Preferred, thanks to the combination of a generous welcome bonus, flexible points, and perks like the DoorDash and hotel credits. I also love transferring my points to Hyatt and United. However, all three are solid options depending on your spending style and travel goals.

Start with one card, learn the ropes, and you’ll be flying (literally) into the world of travel rewards before you know it.

View Current Chase Sapphire Preferred Sign Up Offer

Check out my Youtube video where I break down these 3 cards in depth