How to Redeem Points and Miles for Maximum Value

Earning points and miles is exciting, but the real magic happens when you redeem them. Unfortunately, this is where most beginners leave significant value on the table. The good news? With the right strategies, you can consistently get 2–5 cents per point (cpp) or more and turn your rewards into incredible, often luxurious travel experiences.

In this guide, we’ll cover the most valuable ways to redeem your points, the common pitfalls to avoid, and how to maximize the value of your points so that you always get the best deal possible on your travel.

Why Redeeming Points the Right Way Matters: The Cents Per Point (cpp) Principle

Think of your points like a high-yield investment. Spending them wisely means more trips, better hotels, and even business-class flights that you wouldn't otherwise afford. Spending them poorly is like burning cash — which happens all the time when beginners redeem points for gift cards or low-value travel portal bookings.

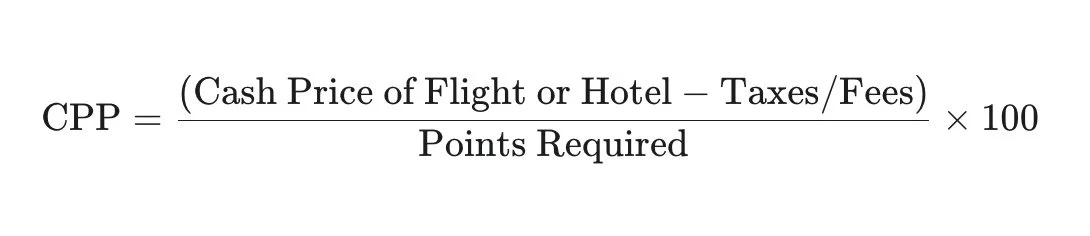

The key to smart redemption is the Cents Per Point (cpp) metric, which tells you the true monetary value of your rewards.

Formula:

Your Points are Not Monopoly Money

You must view your points as another currency, not as "Monopoly money" or a free bonus. You earned these points through strategic spending, credit card sign-up bonuses, and meeting minimum spend requirements. They are a tangible asset. Because they are a valuable currency, it is your responsibility to maximize them and redeem them for the best possible value. For any transferable currency (like Chase Ultimate Rewards or Amex Membership Rewards), you should never redeem them for less than 1 cent per point, as this is equivalent to cashing out money at a discount.

The Difference Between Bad and Great Value

Understanding this formula is everything. If you redeem 50,000 points for a $500 gift card, you get 1.0 cpp. That's the baseline and the lowest value in which you should redeem your transferrable points.

However, if you transfer those same 50,000 points to an airline partner and book a round-trip business-class flight to Europe that normally costs $2,400 (with $150 in taxes/fees), your calculation is ($2,400−$150)÷50,000=0.045=4.5 cpp.

This massive difference illustrates why a minimum of 1.0 cpp is your acceptable threshold, and you should try to aim for 1.5-2 cpp or higher by transferring your point to travel partners. (See here - What Are Transfer Partners?)

Use my Cents Per Point Calculator to quickly see the value of any redemption.

The Big Mistake Most Beginners Make: The Low-Value Traps

The single largest mistake in travel hacking is redeeming points for things that have a fixed, low value, regardless of the card you hold. Avoid these low-value traps (typically 0.8–1 cpp):

Cash Back/Statement Credits: Using points to pay off your bill. This is just selling your rewards at a severe discount. If you are getting 1 cent per point and are just redeeming your points for cash back as a statement credit, then you need to sit down and do the math. Are you putting your purchases all on a card that earns 1X? If so, then you are leaving money on the table because you could do way better with a 2% everywhere cash back card.

Gift Cards & Merchandise: These usually offer the absolute worst value (often 0.6 to 0.8 cpp). I never recommend this. And this goes for using your points on Amazon to wipe out your purchases. It ONLY makes sense to use your points to pay on Amazon when there is a targeted offer on your Amazon account, such as, get 50% off of your order when you use points. In that case, you can use 1 point towards your purchase to get the discount. This is a more advanced technique though, so in general, just don’t use your points on Amazon or towards gift card purchases.

Non-Boosted Portal Bookings: As discussed below, many bank portals now default to a low 1 cpp unless a specific promotion is active. 1 cpp isn’t terrible value, but you can do better. In terms of the Chase Travel portal, I would not recommend using your points on redemptions through the portal unless you have a points boost. Why? Because you are only getting 1 cent per point value. You are better off cashing out those points for a statement credit at 1 cent per point, and then using a different card to purchase your travel directly with the airline or hotel. You then earn points on the purchase with the card that you paid for, and you can pay yourself back with the statement credit. Therefore, you are getting more than 1 cent per point value. Learn about the Chase Travel Portal and Points Boost Here (Video).

Does this sound complicated? It can be, but it also doesn’t have to be. It’s all a game. The more strategic you are, the more points you can earn and redeem.

Your Goal: Resist the urge for instant gratification. Save your points for high-value redemptions aiming for 1.5-2 cpp or higher. Use cash back or statement credits if it makes sense strategically.

Transferring Points to Travel Partners (The Best Option)

This is the “travel hacker’s secret weapon” and the primary way to achieve 2–5 cpp redemptions. Instead of booking through the bank's portal, you convert your points into an airline's or hotel's native currency.

Why Transfers Work for High Value

The magic lies in fixed award charts. Many airline and hotel programs set a points cost for a flight or room that doesn't track directly with the cash price. When cash prices are high (e.g., last-minute, holidays, or premium cabins), the points cost remains the same, skyrocketing your cpp value. There can also be a lot of value in dynamic pricing as well, but it is less predictable.

You can access sweet spots like off-peak flights, premium cabins, or unique hotel awards, which are virtually impossible to match via a bank portal. For example, using Chase Ultimate Rewards to book through World of Hyatt is widely regarded as the most valuable hotel points redemption in the game. An example might be transferring 60,000 Chase points to Hyatt for a five-night stay at a luxury hotel that would cost $1,200 cash, resulting in a solid 2 cpp redemption.

Key Transfer Programs and Partners

The major bank programs all partner with valuable airlines and hotels:

Chase Ultimate Rewards transfers to airlines like United, Air France/KLM, and Virgin Atlantic, and hotels like World of Hyatt (often the highest value), IHG, and Marriott.

Amex Membership Rewards offers a vast network, including Delta, ANA, Air Canada, Avianca, and more, with hotel partners like Hilton and Marriott.

Capital One Miles partners include Air Canada, Turkish, Air France/KLM, and Avianca, along with hotels like Wyndham and Choice.

Citi ThankYou Points transfers to partners such as Avianca, Turkish, Qatar, and Choice Hotels.

Most transfers are 1:1, meaning 1,000 bank points become 1,000 partner miles/points.

Pro Tip: Look for Transfer Bonuses Banks frequently offer 20–40% transfer bonuses to select partners. A 25% bonus instantly turns a good deal into an exceptional one, effectively boosting your value. A 2 cpp redemption becomes 2.5 cpp with a 25% bonus! Watch for these, as they are a key to maximizing value.

Redeeming Through Bank Travel Portals

As we discussed earlier, most major banks have travel portals (e.g., Chase Travel, Amex Travel, Capital One Travel) where you can redeem points like cash. The rules for the Chase portal have changed significantly, making this section critical.

Chase Travel Portal Changes: The Points Boost Era

The Chase Travel portal now defaults to 1 cent per point (1 cpp) for all cardholders, even those with premium cards like the Sapphire Preferred or Reserve. Your fixed 1.25 cpp or 1.5 cpp rate is gone. The only way to get a higher value is through Points Boost. If a flight or hotel is flagged with a Points Boost label, your redemption can increase to 1.25 cpp, 1.5 cpp, or even 2 cpp, depending on your card and the booking.

Bottom Line: Portals are convenient, but rarely the best value unless you are seeing a 1.5 cpp or higher Points Boost. If you are not seeing a boost, transferring points to a travel partner for a 2+ cpp redemption is almost always the superior strategy.

Pro Strategies for Maximizing Value

Redemption success is a blend of knowing the rules and using hacker-level tactics.

Embrace Flexibility

Award availability can vary dramatically. You will find better deals by being flexible with:

Dates: Shifting travel by a day or two can open up much cheaper award flights.

Routing: Sometimes flying a partner airline or connecting through a different city can dramatically reduce the points required.

Use Partner Airlines Strategically

The key to high-value transfers is understanding airline alliances. You don't have to transfer to Delta to fly Delta. You can book the same Delta seat using points transferred to Virgin Atlantic or Air France/KLM (Flying Blue), which often have cheaper award rates for those seats! This is known as "partner booking." Always check 2–3 different alliance partners to see which one offers the lowest points price for your desired flight.

Know When to Use Points for Convenience

Not every redemption needs to be a 4 cpp home run. Sometimes convenience is valuable.

Emergency Travel: Booking a last-minute flight through a portal at 1 cpp because you need to get there now.

Portal Boosts: Taking a 1.25 cpp boosted offer on a flight because it saves you the time and effort of searching for an award seat through a transfer partner.

Using points means the trip can happen: Sometimes money is tight. Even if the cpp value is “low”, if using points is the only way that this trip is going to happen, then use your points and take the trip. Points are a tool, just like money, for you to be able to enhance your life. Be knowledgable about cents per point value, but don’t obsess over it. And don’t let it stop you from traveling and make you overanalyze every redemption.

The key is intentionality—know the trade-offs and choose what works for your current travel goals.

The Bottom Line: Your Redemption Checklist

Redeeming points effectively is all about value, strategy, and patience.

Avoid the Traps: Never redeem for gift cards, merchandise, or <1 cpp statement credits.

Check the CPP: Always run the numbers. Is it 1.5 cpp or higher? If not, how can you get more value?

Maximize with Transfers: Transfer points to airline and hotel partners (especially World of Hyatt) whenever possible to unlock premium cabin and high-cash-value redemptions.

Watch for Bonuses: Track transfer bonuses (20-40% boosts) to turn good redemptions into phenomenal ones.

With the right approach, your points can take you farther than you ever imagined—from luxury hotels to business-class flights—all without touching your savings.

Ready to Redeem Smarter?

Grab my Free Beginner’s Guide to Points & Miles and my Cents Per Point Calculator to see exactly how much your points are worth before you book.