Why I Was Willing to Pay $8,000 in Annual Fees

High annual fees make a lot of people uncomfortable.

And honestly, that reaction makes sense.

Seeing a $700 or $900 charge hit your statement feels painful, even when the math works in your favor. Our brains fixate on the loss upfront and ignore everything that comes after it.

But annual fees aren’t inherently good or bad. They’re a tool. And like any tool, they can either work against you or quietly fund your travel year after year.

Over the last 12 months, I’ve built a system around premium travel credit cards, one that’s designed to generate points, offset real expenses, and remove friction from family travel.

Once you understand the system, the number itself becomes a lot less scary.

So here’s the full breakdown: what I paid, what I used, and why annual fees don’t scare me when they’re backed by strategy.

If you’re newer to points and miles and want a more high-level explanation of how annual fees work, I have a separate Travel 101 post that walks through the fundamentals here: Are credit card annual fees worth it?

The ground rules

Before getting into specific cards or benefits, there are a few ground rules. These are what keep the math honest and the conclusions useful.

Here is what I am counting:

Only cards with annual fees

Only value from the last 12 months

Only credits and benefits I actually used or will use before canceling or downgrading

Cards held across my entire household (player 2), not just me

Here is what I am not counting:

No annual fee cards

Hypothetical or aspirational value

Points earned in prior years

Value that requires changing my spending behavior

This is one annual fee cycle. One snapshot in time.

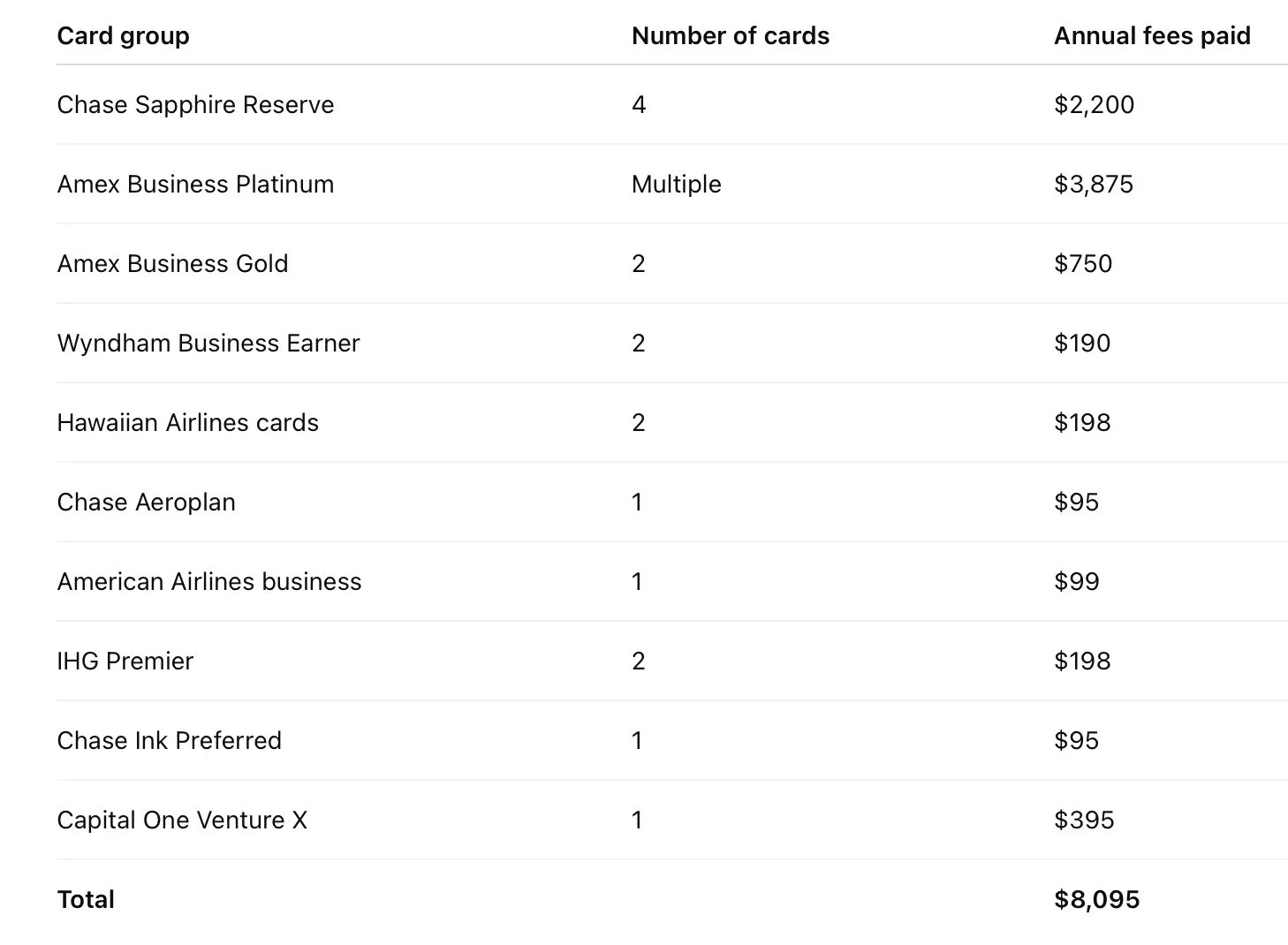

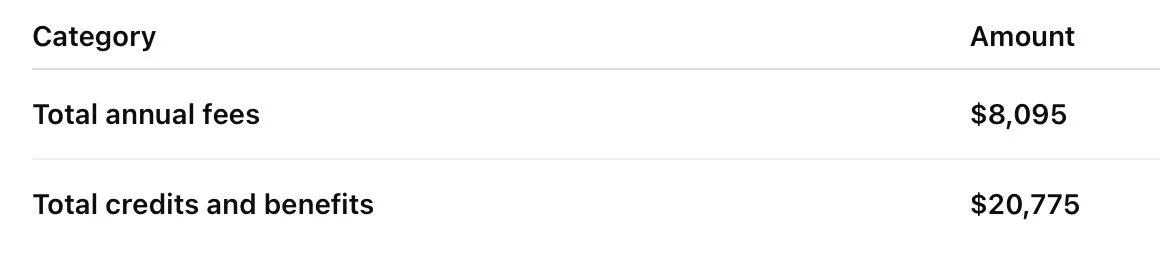

The total cost

Across all of my cards, my total annual fees for the last 12 months came out to:

$8,095

Yes… that is a large number.

But a number on its own does not mean anything without context. A fee is only expensive if it is not doing a job.

The card lineup

I carry a mix of premium travel cards, mid tier cards, and a small number of airline and hotel cards that serve very specific purposes.

Some of these cards are long term holds.

Some are short term tools.

Some are already scheduled to be canceled or downgraded.

Not every card is meant to be permanent. I keep cards as long as the math works. When it stops working, I move on.

Annual Fees Paid By Card Group

How I evaluate value

I separate value into two categories.

Offset value

These are credits that replace money I would have spent anyway. Travel credits, dining credits, hotel credits, subscriptions I already use. If a credit replaces a real expense, I count it. If it forces me to spend differently, I do not.

Strategic value

This includes transfer bonuses, elite status, lounge access, and benefits that reduce friction when traveling as a family. This value matters, but I only count it after the annual fee is already justified.

The rule is simple. Offset first. Upside second.

Chase Sapphire Reserve (4 cards)

Before getting into the benefits, I want to clarify why the annual fee on these cards is $550 each.

I product changed into each of my Chase Sapphire Reserve cards before Chase increased the annual fee. Because of that timing, all four cards renewed at the old $550 rate instead of the higher current fee.

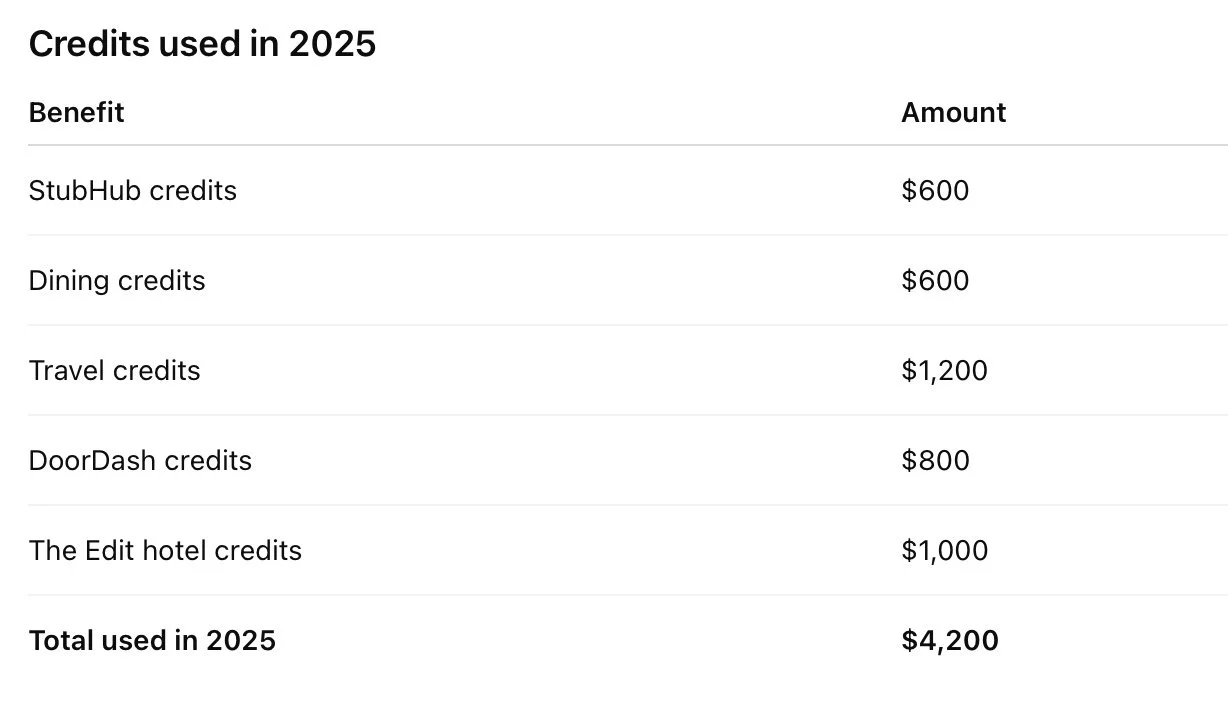

Now let’s look at the value. In my valuations, I am separating what I have already used from what I will use before canceling based on how these credits are structured.

StubHub

I used $600 in StubHub credits in 2025. When booking those tickets, I stacked Capital One Shopping and hit a targeted 45 percent cash-back offer, which returned $270 as a Walmart gift card. That went directly to groceries. Stacking matters.

Dining credits

I used $600 in dining credits in 2025. These are higher-end restaurants, but luckily and I live near a few Chase Exclusive Tables locations.

Travel credit

Each card includes a $300 annual travel credit. Across four cards, that is $1,200 used.

DoorDash

Each card provides $25 per month. Across four cards, that is $100 per month. I used about eight months of credits for pickup orders, avoiding fees and tips, totaling $800.

The Edit hotel credits

Each card includes $250 in credits. Across four cards, that is $1,000 already used.

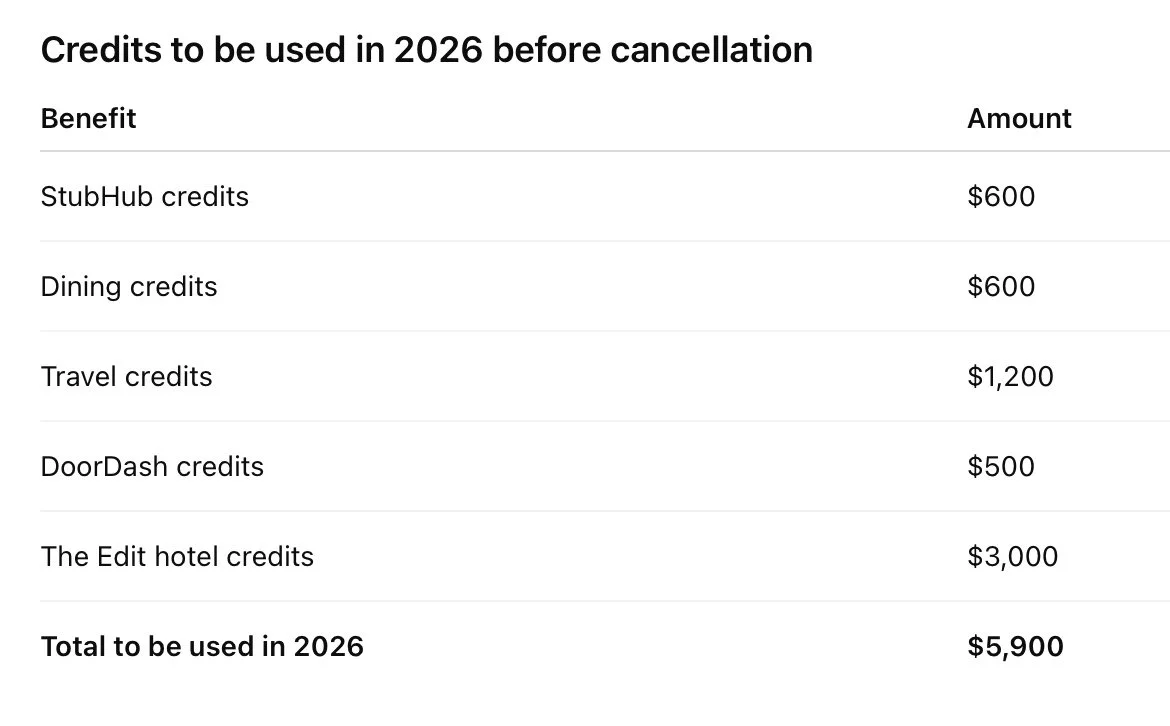

Benefits I will use in 2026 before canceling

Because several Chase Sapphire Reserve benefits are based on calendar years rather than cardmember years, I can use them again in 2026 before canceling or downgrading these cards.

These are not hypothetical. These are credits I have already planned and will use based on past behavior.

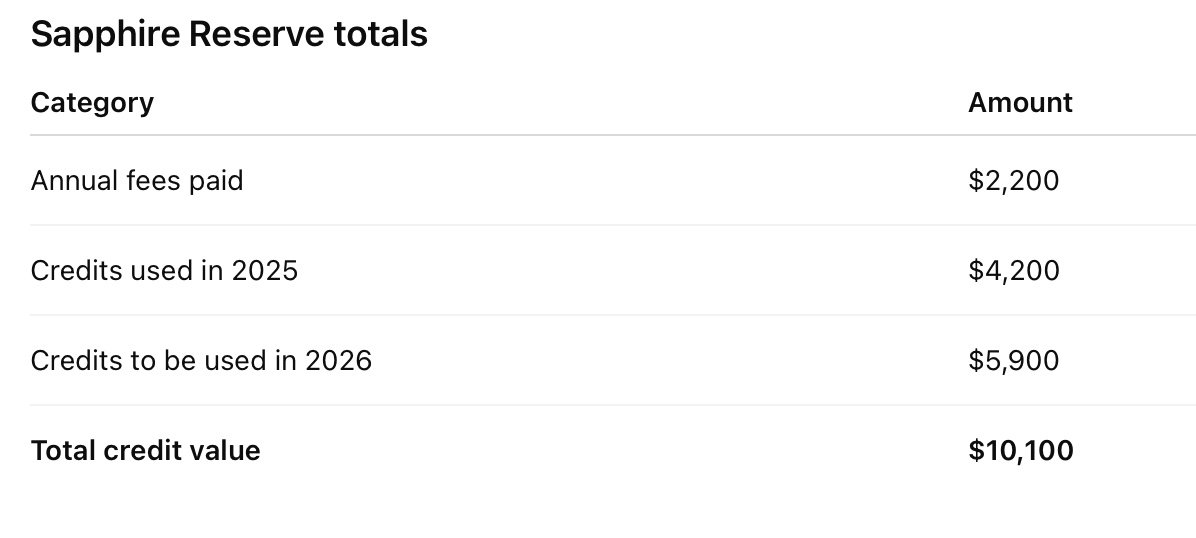

So when you zoom out and just look at the Sapphire Reserves by themselves, here’s the math. I’ve already used $4,200 in credits. I’ll use another $5,900 before canceling. That’s $10,100 in total value, from cards that cost me $2,200 in annual fees.

Chase Sapphire Reserve Total Value

If you want a deeper breakdown of how this card works outside of this case study, I have a full Chase Sapphire Reserve review here.

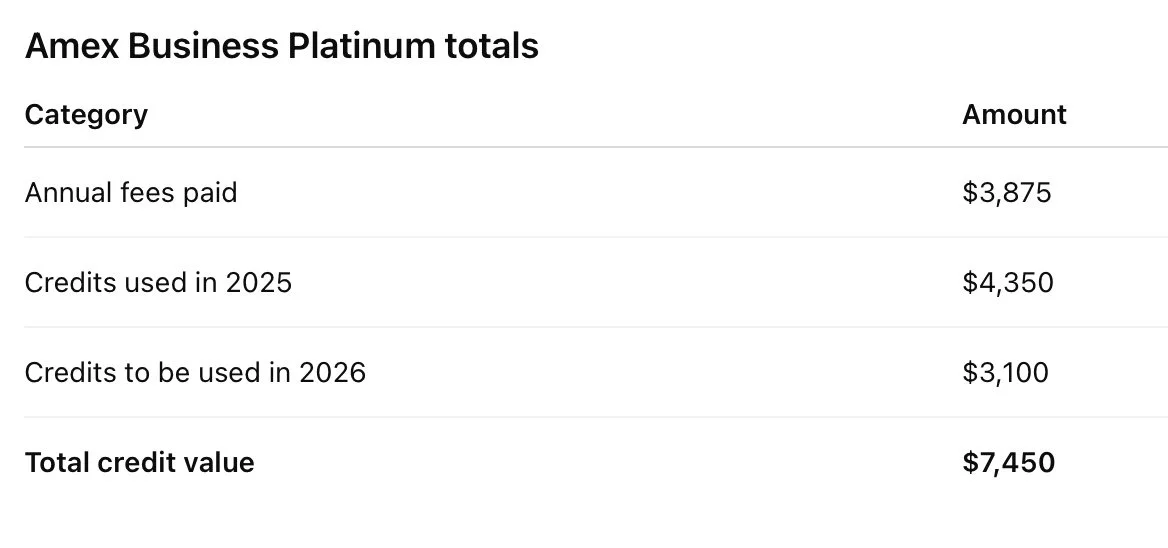

American Express Business Platinum (multiple cards)

Next up are the American Express Business Platinum cards.

Across these cards, the total annual fees came out to $3,875. At one point, I had five of these cards. The sign-up bonuses were strong, which is why I stacked them. One of them has already been canceled, which is reflected in the totals below.

As with the Sapphire Reserves, the key is separating what I’ve already used from what I will still use before cancellation.

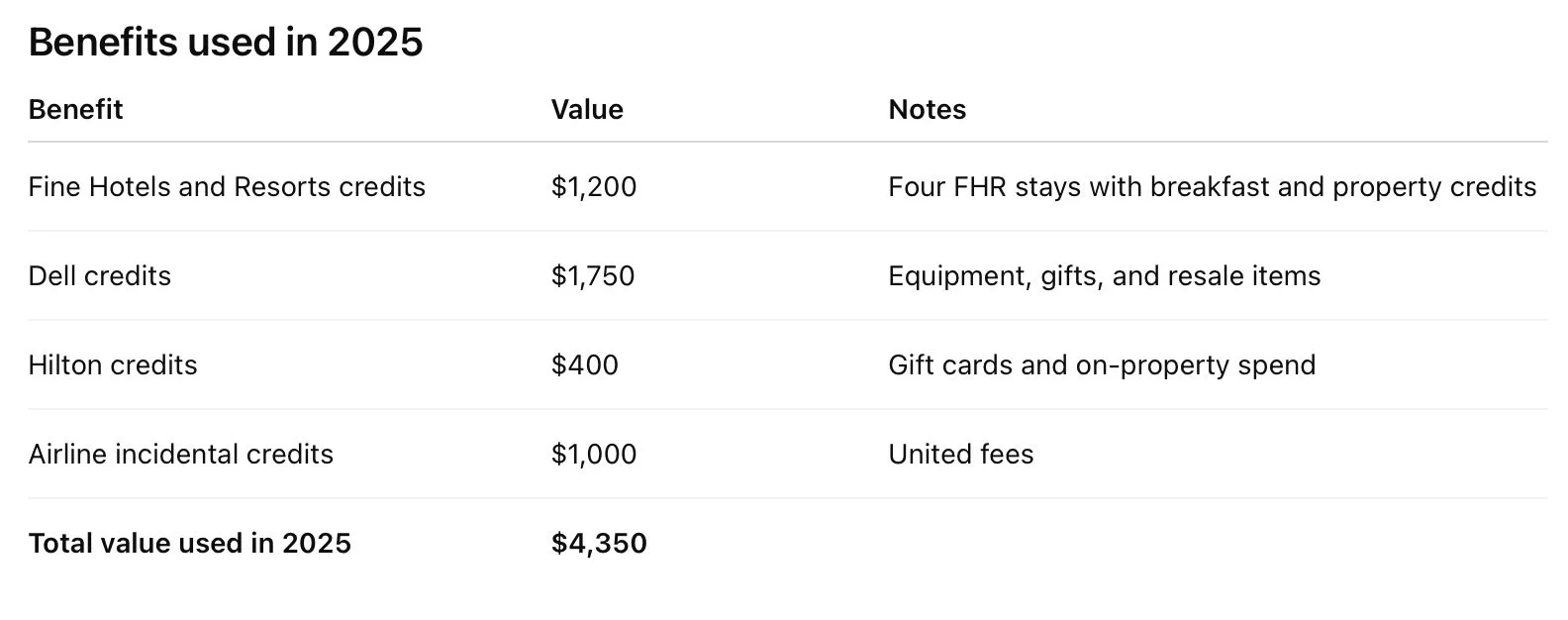

Fine Hotels & Resorts

I used four FHR credits in 2025, totaling $1,200. These stays included free breakfast and property credits, which adds value beyond the room rate.

Dell credits

I used $1,750 in Dell credits on items I needed, including home cameras, a Chromebook, Christmas gifts, and PlayStation controllers that I resold.

Hilton credits

I used $400 total. $200 went toward Hilton gift cards, and $200 was spent at a Starbucks inside a Hilton.

Airline incidental credits

I used $1,000 on United.

In 2026, I will use additional FHR credits, Hilton credits primarily as Starbucks gift cards, and the remaining airline incidental credits before these cards are canceled or downgraded.

Amex Business Platinum Summary

That is $7,450 in credit value from cards that cost $3,875 in annual fees.

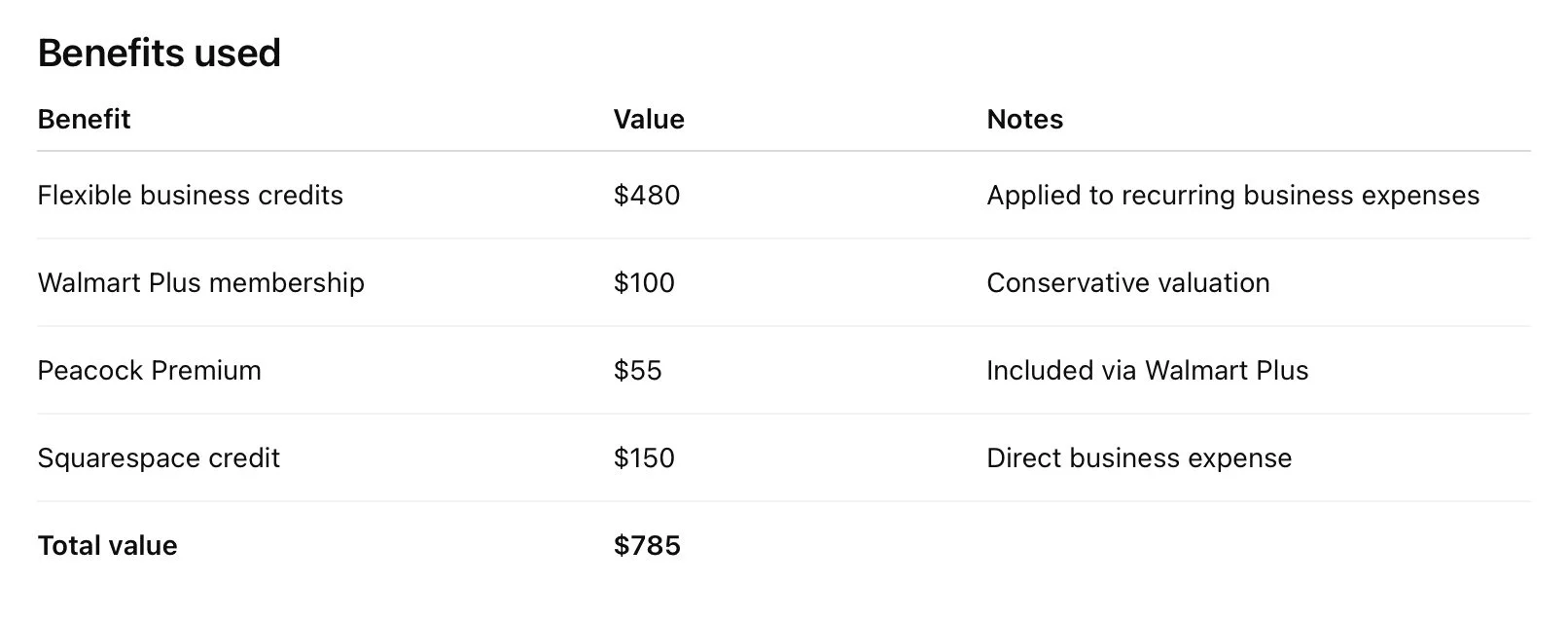

American Express Business Gold (2 cards)

The American Express Business Gold cards play a very different role than the premium travel cards above. These are not about luxury perks or aspirational benefits. They are practical business cards designed to offset real expenses while earning points efficiently.

I hold two Business Gold cards. Across both cards, the total annual fees paid over the last 12 months came out to $750.

I used $480 in flexible business credits. I also received a Walmart+ membership, which I’m conservatively valuing at $100, and that membership includes Peacock Premium, which I value at about $55.

I’ll also be using the $150 Squarespace credit before canceling. My blog is hosted on Squarespace, so this is a real, necessary expense for me.

All in, that puts the total value at $785 from cards that cost $750 in annual fees.

I’ll either be canceling or upgrading these cards soon since they’re coming up for renewal, so I’m not counting any future credits beyond what’s listed here.

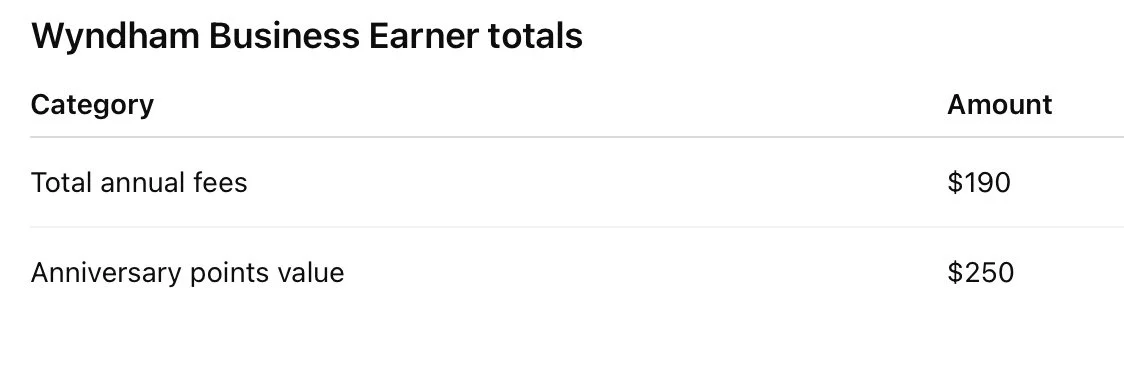

Wyndham Business Earner (2 cards)

Next are the Wyndham Business Earner cards. I have two of them, with $190 total in annual fees.

Each card comes with 15,000 anniversary points, so across both cards that’s 30,000 Wyndham points. I value those conservatively at $250.

One of these cards also unlocked six heavily discounted cruises for my family through Caesars Diamond status, which I’ll cover in a separate piece. That value is real, but since it’s harder to assign a clean dollar figure, I’m keeping this section conservative.

Hawaiian Airlines cards (2 cards)

I also have two Hawaiian Airlines cards, with $198 total in annual fees.

There are no credits on these cards, and that’s fine. These are pure strategy cards.

I needed to keep one Hawaiian card in order to transfer Hawaiian points between my account and Player 2’s account. I didn’t need to keep both after the first year, and I forgot to cancel one when it renewed, which added an extra $99 I didn’t need to spend.

This is a good example of where strategy matters, but so does cleanup.

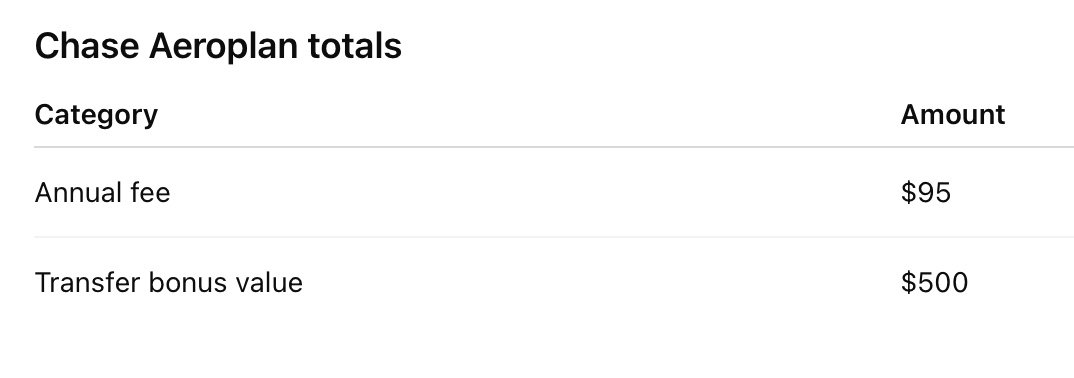

Chase Aeroplan Card

Next is the Chase Aeroplan card, with a $95 annual fee.

I use this card heavily because I transfer points to Aeroplan all the time.

With this card, you get a 10% points bonus when transferring at least 50,000 Chase Ultimate Rewards points to Aeroplan, capped at 25,000 bonus points per year. I make sure to stack this with transfer bonuses whenever possible.

Since I redeem Aeroplan points primarily for business class flights, I value those 25,000 bonus points at a minimum of $500.

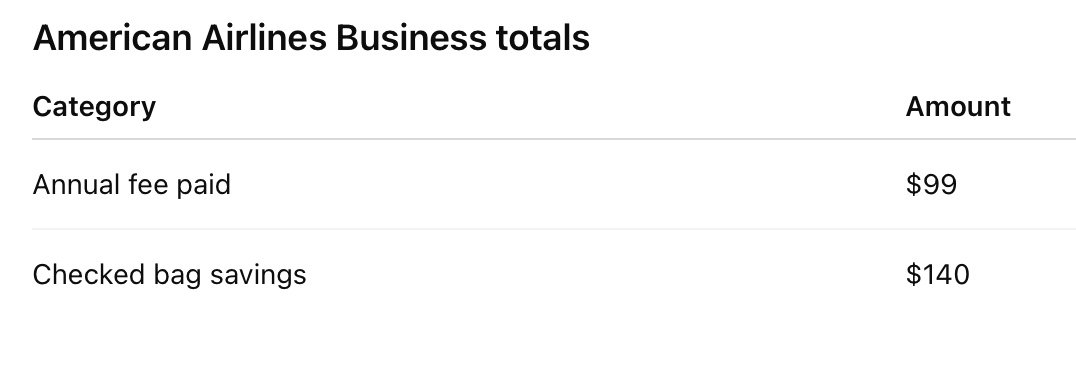

American Airlines Business Card

For the American Airlines business card, the $99 annual fee was waived the first year. I’m now in year two, so I’ve paid the fee once.

Because I was a cardholder, we received four free checked bags when flying American Airlines, which saved $140.

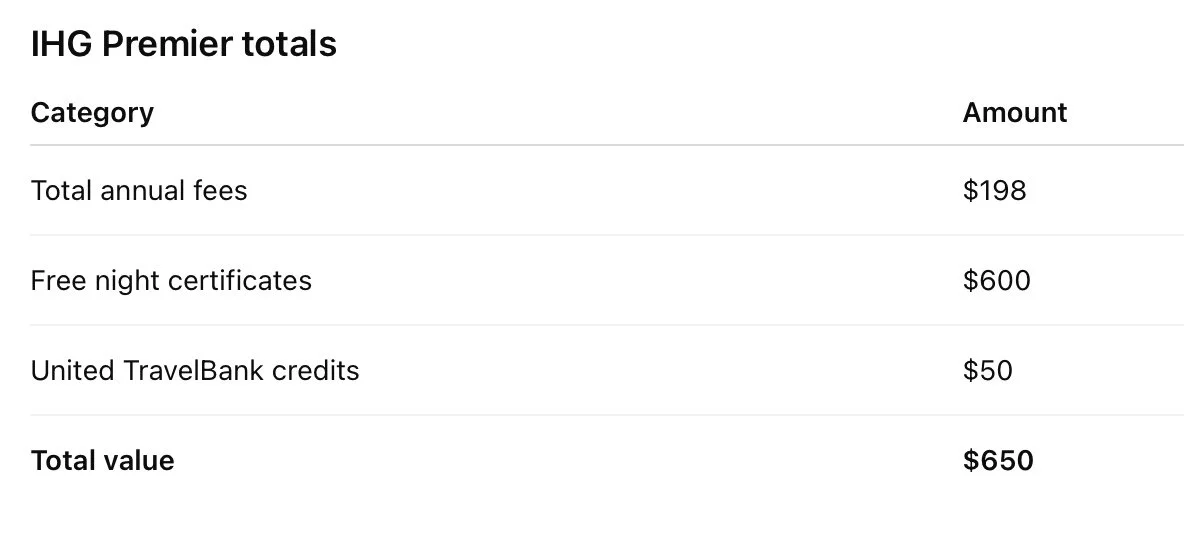

IHG Premier Cards (2 cards)

I have two IHG Premier cards, with $198 total in annual fees.

I used both free night certificates at the Kimpton in Barcelona, which saved us $600. I also used two $25 United TravelBank credits, adding another $50.

I’ll admit I sometimes let those TravelBank credits expire because they’re small and expire quickly, but I actually used them this year.

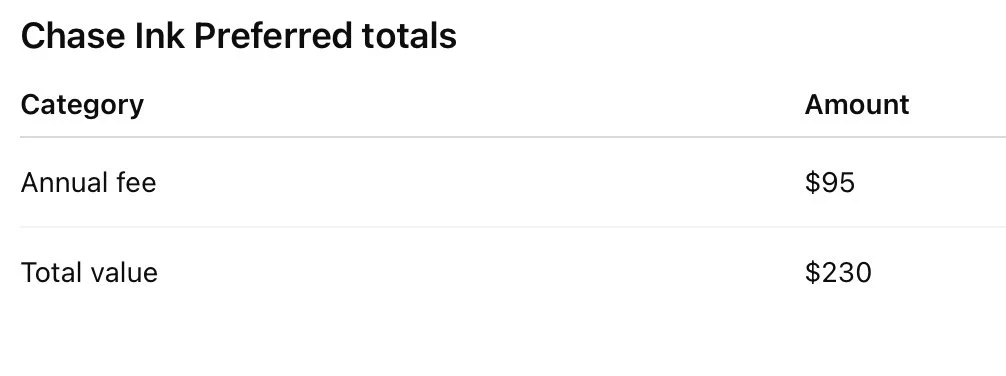

Chase Ink Preferred

Next is the Chase Ink Preferred, with a $95 annual fee.

This card gave me $180 in Instacart credits and a $50 hotel credit this past year, for $230 total value. That hotel credit was a one-off perk in 2025 and isn’t a standard benefit, but it still counts.

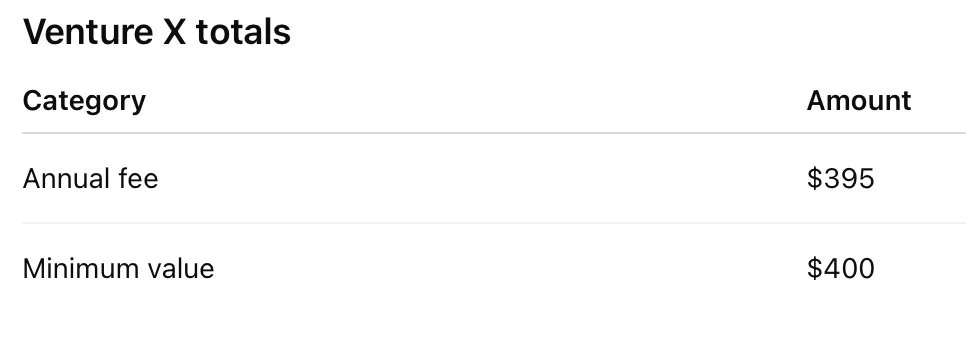

Capital One Venture X

Finally, there’s the Venture X, with a $395 annual fee.

This one is straightforward. You get a $300 travel credit, 10,000 anniversary points, and lounge access. Even conservatively, that’s at least $400 in value.

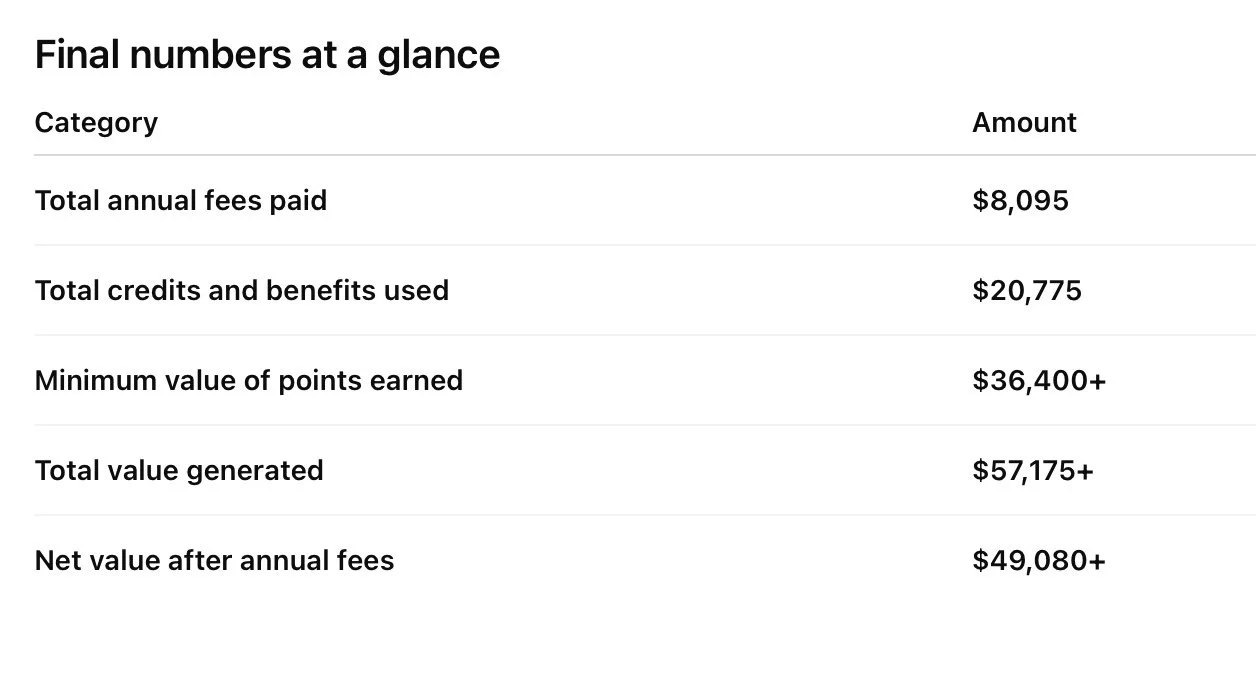

Total Annual Fees vs. Credits and Benefits

That total includes credits already used and credits that will be used before cancellation based on how these benefits are structured.

That’s more than double what I paid, and we still haven’t talked about points yet.

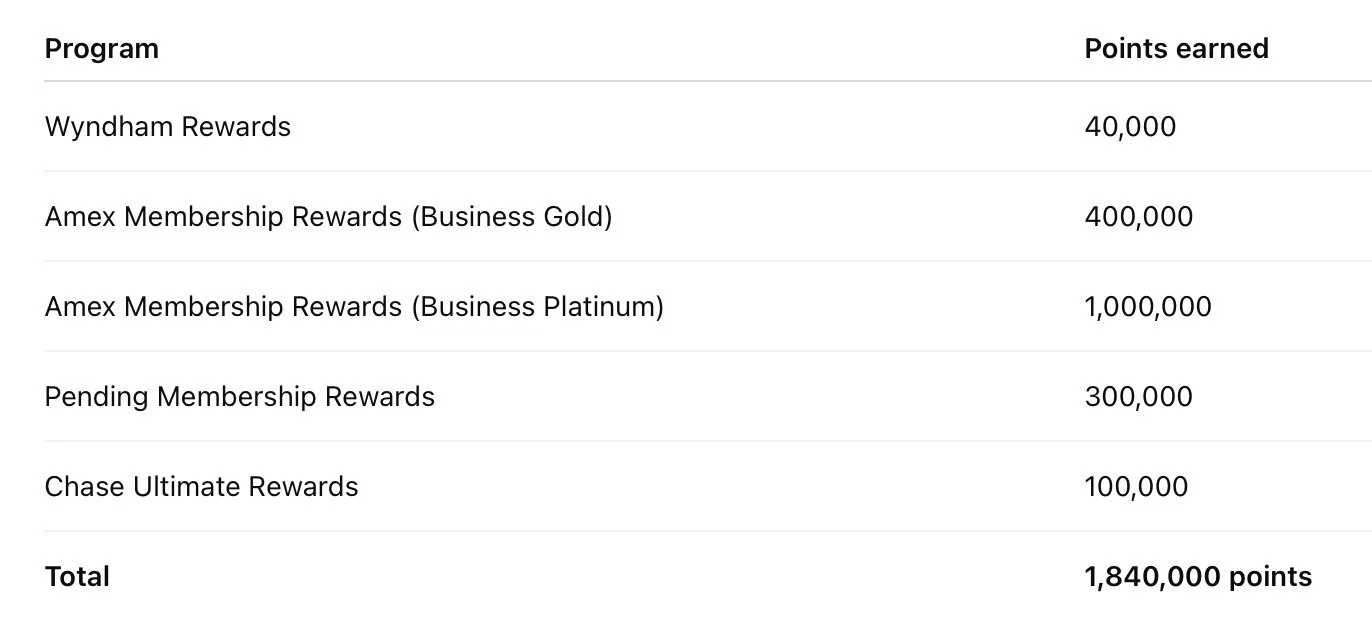

Points Earned

Up to this point, everything we’ve looked at has been credits and benefits only. No points, no redemptions, just the math on how much of the annual fees were offset on their own. Once those fees are largely covered, the points earned from these cards become the real upside. That’s where the trips actually come from. So let’s look at the points earned in the last 12 months.

To value these points, I use a conservative floor based on how I actually redeem.

Transferable points (Amex and Chase): 2 cents per point

Wyndham points: 1 cent per point

That puts the value at:

1,800,000 transferable points × $0.02 = $36,000

40,000 Wyndham points × $0.01 = $400

So just from welcome bonuses, that’s $36,400+ in minimum value.

This does not include:

Points earned from everyday business or household spending

Welcome bonuses earned in previous years

Between all of these cards, I also earned well over 100,000 additional points from spend alone, but I’m intentionally not counting those here.

And importantly, this wasn’t one year of value. This was one annual-fee cycle that generated multiple years of travel, with a large balance of points still sitting unused.

Which leads to the real question.

It’s not “are annual fees worth it?”

It’s: what did those points actually book?

What those points actually booked

Once you move past the math and into real bookings, this is where the system becomes tangible.

First, we’re taking an eight-night Caribbean cruise. We’re only paying port fees and taxes because the Wyndham Business Earner cards gave me access to Caesars Diamond status, which unlocked the deal. The cash price for that cruise is right around $5,000.

That’s a full family vacation covered, and we haven’t even touched flights yet.

Next, we booked round-trip business class flights from Atlanta to Lima, Peru for all four of us. We’re flying LATAM in business class, and the cash price for those tickets was $22,500. That’s not aspirational pricing or some inflated number. That’s what those seats were actually selling for.

On the hotel side, our Fine Hotels & Resorts credits are covering three nights in Cusco at the Inka Palace. That stay includes free breakfast and a property credit, and the cash value comes out to about $1,150.

The Edit credits are also doing a lot of heavy lifting. We’re using them for two separate four-night stays in Las Vegas, plus three nights in San Antonio. One of those stays is paired with another Fine Hotels & Resorts booking, which again includes breakfast and property food credits. The combined cash price for those stays is about $2,000.

We also booked four business class seats to Europe on Condor. The cash price for those flights was $12,800.

To get home, we booked business class flights from Europe using Air France points transferred from Amex. Those flights were selling for $11,305.

And we didn’t forget about Disney. We booked a week at the Hyatt Regency Grand Cypress using Chase points from a welcome bonus. On top of that, we’re using Disney gift cards purchased with Amex Business Gold credits to help offset the cost of park tickets. Even that trip is layered together with points and credits.

When you zoom out, these cards didn’t just pay for one trip. They paid for cruises, multiple international business class flights, luxury hotels, family vacations, and experiences we simply would not have booked with cash.

Why this works differently for families

This is where the psychology of “free” really matters.

When flights are already covered with points, hotels are already paid for, and credits are sitting there waiting to be used, you interact with travel differently. You say yes more easily. You stay the extra night. You book the experience instead of talking yourself out of it because of the price.

It removes friction.

Instead of constantly asking, “Is this worth it?” you’re asking, “When do we want to go?”

With a family, that matters even more. Travel is already more expensive, more complicated, and easier to postpone. These cards create momentum. In a good way, they push you to actually take the trips, make the memories, and do the things that are very easy to delay when everything comes with a big price tag attached.

This is the part that gets lost when people look at annual fees and points purely on a spreadsheet. The value isn’t just in the dollars saved. It’s in the experiences that actually happen.

For me, that’s the real return.

A quick reality check

Sometimes you really do have to pay to play, especially when you’re trying to generate enough points to travel extensively with a family.

That said, I don’t open cards with annual fees without doing the math first. I don’t open cards hoping I’ll figure it out later. And I don’t count credits unless they replace something I was already going to spend money on.

My background as an extreme couponer actually helps here. Coupon books don’t scare me. But just like couponing, I don’t walk into a store without a plan. Coupons without a plan are just overspending in disguise.

If you’re getting a large welcome bonus, cards with annual fees almost always make sense in year one, even if you don’t maximize every single credit. That’s not controversial. That’s just math.

Where people get stuck is after year one. They keep cards they’re no longer using, forget to cancel or downgrade, or spend money just to use credits that don’t fit their lifestyle. When a card stops making sense, I cancel or downgrade it.

And to be very clear, this is not me telling beginners to rack up thousands of dollars in annual fees. You don’t need to do that. This year, I had the capacity, I had a plan, and I wanted to see what was possible. That does come at a cost, but the results speak for themselves.

I showed you the receipts. The credits. The points. The trips. And the future travel that’s already funded.

So no, I didn’t pay $8000 for one year of travel. I used $8000 to build a system that’s funding multiple years of travel for my family.

The Psychology of Money

This whole conversation reminds me of a book I really like called The Psychology of Money.

One of the big ideas in that book is that most money decisions are not really about math. They are about emotion. We do not react to numbers logically. We react to how those numbers feel.

Annual fees are a perfect example.

Seeing an $800 or $900 charge hit your statement feels painful, even when the math clearly works in your favor. Our brains fixate on the loss upfront and ignore what comes after.

But when you slow down and actually do the math, the credits, the points, and the travel, the story changes. The fee is not the problem. The fear is.

And once you understand that, it becomes a lot easier to make calm, intentional decisions instead of emotional ones when it comes to cards with annual fees.

If you want to read it, here is the book: The Psychology of Money on Amazon

The takeaway

Annual fees aren’t something to fear, but they aren’t something to ignore either.

When you slow down and actually do the math, they become a lot less emotional. Credits offset real expenses. Points create upside. And when everything is working together, annual fees stop feeling like a loss and start functioning as part of a larger system.

This isn’t about carrying the most cards or paying the highest fees. It’s about being intentional, knowing when the math works, and knowing when it doesn’t.

When annual fees are backed by strategy, they can quietly fund years of travel instead of standing in the way of it.

***If you’re thinking about adding a new card and want to see which offers are actually worth considering right now, I’ve put together a page with the best credit card offers and how I think about using them.