Chase Freedom Flex Review (2025): Unlock 5% Cash Back & Supercharge Your Travel Rewards!

Finding a credit card that showers you with rewards without charging an annual fee can feel like searching for a unicorn. Many cards promise big rewards but come with hefty fees, while others are free, but offer lackluster returns. It's a challenge to find that perfect balance. But what if I told you there's a card that offers a whopping 5% cash back in key categories, plus solid earnings on everyday spending, all for a $0 annual fee?

Enter the Chase Freedom Flex credit card. This card has become a powerhouse in the no-annual-fee arena, largely thanks to its rotating quarterly bonus categories that can seriously accelerate your earnings. Add in strong fixed bonus categories and some surprisingly valuable perks, and you've got a compelling contender for a spot in your wallet.

Right off the bat, the Freedom Flex typically welcomes new cardmembers with an attractive bonus: Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. Keep in mind that welcome offers can change, but this provides an immediate boost to your rewards stash.

As a writer specializing in credit cards and maximizing travel rewards, I am always looking for ways to get the most value from every dollar spent, especially when it comes to funding future adventures. In this deep dive, we'll explore everything the Chase Freedom Flex offers – from its unique rewards structure and redemption options to its valuable benefits and potential drawbacks. We'll also look at how it stacks up against competitors and how it can fit into your broader points and miles strategy to help you travel more for less. Let's get started!

Who is the Chase Freedom Flex For (and Who Isn't It For)?

Before diving into the nitty-gritty, let's figure out if the Freedom Flex aligns with your spending style and rewards goals.

The Ideal Cardholder:

The Optimizer / Strategic Shopper: Are you someone who enjoys maximizing rewards and doesn't mind a little "work" to do so? The Freedom Flex shines for those willing to track the quarterly 5% bonus categories and remember to activate them. This card rewards active engagement.

The Chase Ecosystem Builder: If you already hold (or plan to get) premium Chase cards like the Chase Sapphire Preferred Card, Chase Sapphire Reserve, or Ink Business Preferred credit card, the Freedom Flex becomes incredibly powerful. It allows you to pool the points earned, unlocking much higher redemption values, especially for travel.

Beginners Seeking Strong Rewards: For those just starting their rewards journey, the Freedom Flex is an excellent entry point. It offers high earning potential in common categories and valuable perks, all without an annual fee, making it a great card to learn the ropes with.

Those with Significant Spending in Common Categories: If your budget includes substantial spending on groceries, gas, dining, drugstores, or online retailers like Amazon and PayPal (common rotating categories), this card can yield significant returns.

Who Might Look Elsewhere:

Simplicity Seekers: If tracking categories and remembering to activate them sounds like a chore, a flat-rate cash back card might be a better fit. The sister card, Chase Freedom Unlimited, offers simpler rewards with a higher base earning rate.

Heavy Spenders Exceeding Caps: The 5% rotating category bonus is capped at $1,500 in spending per quarter. If you consistently spend much more than that in those specific categories, the value diminishes after hitting the cap. Pro Tip: You can overcome this by having multiple of this card via product changes.

Frequent International Travelers: The Freedom Flex is widely reported to carries a foreign transaction fee of 3%. This makes it less suitable for purchases made abroad compared to cards with no foreign transaction fees. Honestly, I would not use this as a deterrent to having this card. Just leave it at home when you travel internationally, and pick it back up when you get back.

Credit Score Requirement:

Generally, you'll need good to excellent credit to qualify for the Chase Freedom Flex, which typically translates to a FICO score of 670 or higher.

However, a crucial factor looms over any Chase card application: the infamous 5/24 rule. You can read more about that HERE. This unwritten Chase policy means you'll likely be denied for most Chase cards if you've opened five or more personal credit cards (from any bank) in the past 24 months. Getting the Freedom Flex counts as one of those five slots. For readers focused on long-term travel rewards, this means careful planning is needed. If premium Chase cards like the Sapphire Preferred or Reserve are high on your list, you might consider applying for them before accumulating too many other cards, including the Freedom Flex, to avoid being locked out by the 5/24 rule.

Earning Rewards: The Freedom Flex's Multi-Layered Approach

The Chase Freedom Flex stands out with its dynamic earning structure. It’s not just one bonus rate; it’s several layers designed to reward different types of spending.

Headline Feature: 5% Rotating Categories

This is the card's signature feature. Here’s how it works:

The Deal: You earn 5% cash back on up to $1,500 in combined purchases each quarter in specific bonus categories that Chase announces.

Activation is Key: This is non-negotiable! You must activate the bonus categories each quarter to earn the 5%. Forgetting to activate means you'll only earn the base 1% rate on those purchases. Activation is simple and can be done through your online account, the Chase mobile app, by clicking a link in reminder emails, over the phone, or even at a Chase ATM if you're a banking customer.

Activation Deadline & Retroactive Bonus: The good news is that activation is retroactive for the quarter, as long as you activate by the deadline (usually the 14th day of the last month of the quarter – e.g., June 14th for Q2). So, even if you activate in June, you'll earn 5% back on eligible purchases made back in April and May for that quarter.

The $1,500 Cap: The 5% earning rate applies only up to $1,500 in combined spending across the bonus categories each quarter. Once you hit that $1,500 threshold, you'll earn 1% on subsequent purchases in those categories for the rest of the quarter. Maxing this out nets you $75 in bonus cash back, or 7500 Ultimate rewards points, ($1500 * 5%) each quarter.

Category Predictability: While categories change, Chase tends to revisit popular ones. Common categories include grocery stores (often excluding Target and Walmart), gas stations, Amazon.com, PayPal, select streaming services, restaurants, drugstores, and home improvement stores. This predictability helps you plan your spending. There have definitely been some random ones in there though, like Norwegian Cruise Lines and McDonalds.

To give you a better idea, here’s a look at recent and upcoming categories:

Solid Everyday Earners:

Beyond the rotating categories, the Freedom Flex offers consistent bonus rewards on common expenses:

5% on Travel via Chase Travel: Book flights, hotels, car rentals, and other travel through the Chase Travel portal and earn 5% back.

3% on Dining: This includes purchases at restaurants worldwide, from fine dining to fast food, plus takeout and eligible delivery services.

3% on Drugstores: Earn 3% back on purchases made at drugstores like CVS and Walgreens.

The Base Rate:

1% on All Other Purchases: For everything else that doesn't fall into a bonus category, you'll earn a standard 1% cash back.

While Chase markets the Freedom Flex heavily as a "cash back" card, it's essential to understand that you're technically earning Chase Ultimate Rewards points. This distinction is more than just semantics; it's the key to unlocking potentially much higher value, especially for travel. This dual approach allows Chase to appeal to beginners with simple cash back language while integrating the card seamlessly into the valuable Ultimate Rewards ecosystem for more advanced users, effectively creating a pathway towards their premium cards.

Interestingly, sometimes the rotating 5% categories overlap with the fixed 3% categories. For example, restaurants have appeared as a 5% quarterly category. During these periods, the higher 5% rate applies (up to the $1,500 quarterly cap), offering a chance for accelerated earnings. Also, while 5% back on travel booked through Chase Travel is attractive, savvy travelers might find better value or perks booking directly with airlines or hotels, especially those chasing elite status. This portal bonus is most beneficial for those without premium travel cards or those who prioritize the simplicity of booking through Chase.

Redeeming Rewards: Cash, Gift Cards, or Flights?

So you've racked up rewards with your Freedom Flex – now what? Understanding your redemption options is crucial for maximizing value. As mentioned, you're earning Chase Ultimate Rewards points.

Standard Redemption Options (Value: 1 Cent Per Point)

If you only have the Freedom Flex (or other Chase cash back cards), your points are generally worth 1 cent each ($0.01) when redeemed for:

Cash Back: Get a statement credit applied to your card balance or a direct deposit into most U.S. checking or savings accounts. There's no minimum amount required to redeem for cash back, and your rewards won't expire as long as your account remains open and in good standing.

Chase Travel Portal: Use points to book flights, hotels, car rentals, cruises, and activities directly through Chase's online travel portal. With just the Freedom Flex, points are worth 1 cent each here.

Gift Cards: Exchange points for gift cards from a wide variety of retailers, restaurants, and travel brands. The value is typically 1 cent per point.

Shop with Points: Link your card to use points directly at checkout with partners like Amazon or PayPal. Be cautious with this option, as the redemption value is often less than 1 cent per point (around 0.8 cents per point on Amazon), making it generally a poor use of your hard-earned rewards.

The Best Value Strategy: Unlocking Higher Value with Premium Cards

This is where the Freedom Flex truly transforms for travel enthusiasts. If you also hold one of Chase's premium Ultimate Rewards-earning cards – namely the Chase Sapphire Preferred Card, Chase Sapphire Reserve, or Ink Business Preferred Credit Card – you can pool the points earned on your Freedom Flex into that premium card's account. This unlocks two powerful redemption avenues:

Enhanced Portal Redemption: When points are held in a Sapphire Preferred account, they become worth 1.25 cents each when redeemed for travel through the Chase Travel portal. If held in a Sapphire Reserve account, they're worth 1.5 cents each. This instantly increases the value of your Freedom Flex earnings – that 5% category effectively becomes a 6.25% or 7.5% return when redeemed for travel this way!

Transfer Partners (The Ultimate Value): The most potentially lucrative option is transferring your pooled points to Chase's valuable airline and hotel partners. These include programs like World of Hyatt, United MileagePlus, Southwest Rapid Rewards, British Airways Avios, Air Canada Aeroplan, Marriott Bonvoy, and more. By strategically transferring points and booking award flights (especially in business or first class) or hotel nights, savvy users can often achieve redemption values of 2 cents per point or even higher. This turns the standard $200 welcome bonus (20,000 points) into potentially $400 or more in travel value.

For users who pair the Freedom Flex with a premium Chase card, it ceases to be just a cash-back card and becomes a points-earning engine. Its 5% categories often cover spending areas (like groceries or PayPal) where premium cards might only earn 1 point per dollar. By strategically using the Flex for these purchases and then transferring the points, you effectively earn 5 valuable Ultimate Rewards points per dollar, significantly speeding up your journey towards aspirational travel redemptions. This makes the Freedom Flex a cornerstone of popular strategies like the "Chase Trifecta" and a valuable tool even for seasoned travelers.

Beyond Points: Valuable Perks of the Freedom Flex

Many no-annual-fee cards skimp on benefits, but the Chase Freedom Flex packs a surprising punch with valuable protections typically found on cards with annual fees. These perks can offer significant peace of mind and potential savings:

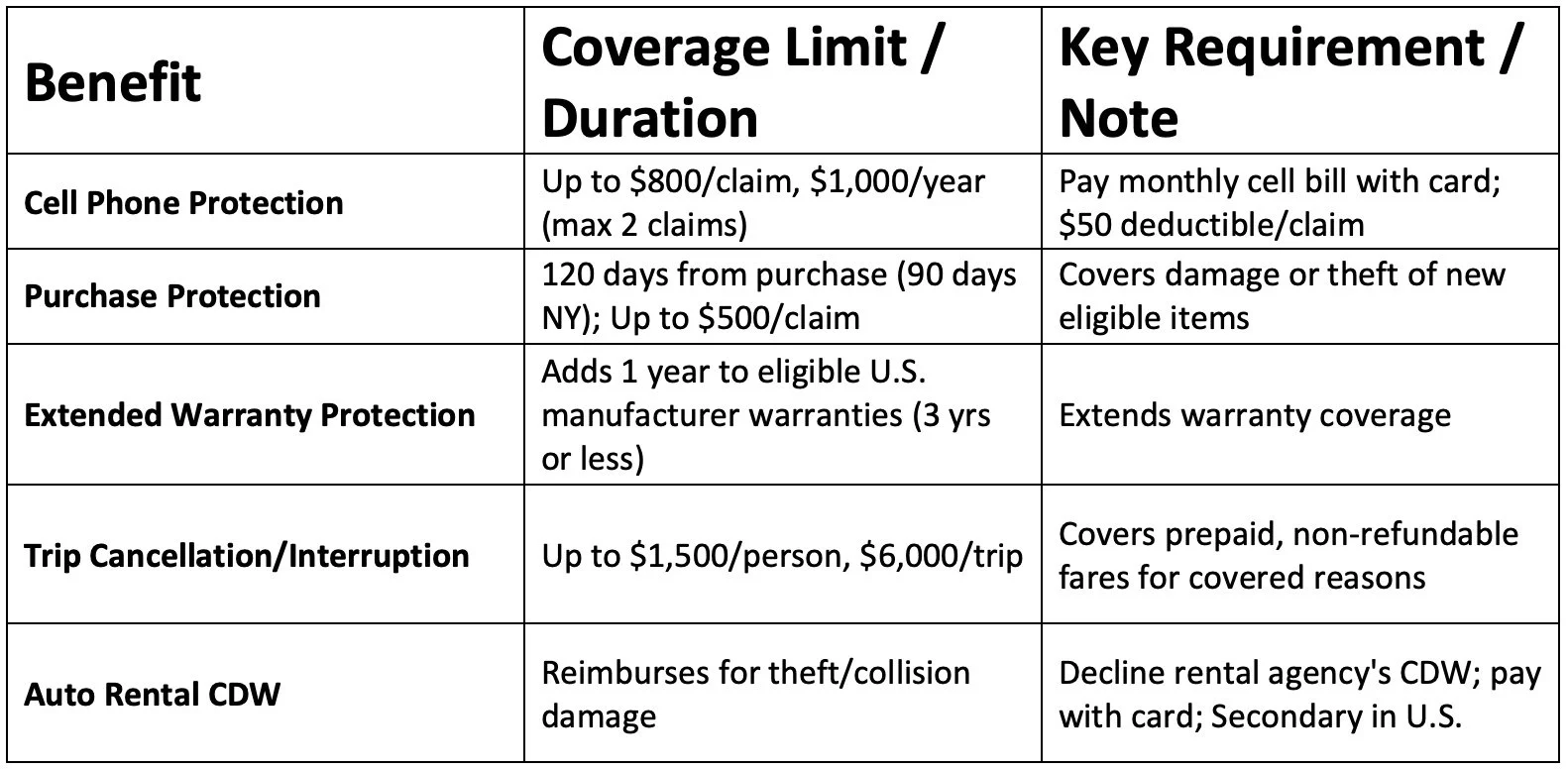

Cell Phone Protection: This is a standout benefit. Pay your monthly cell phone bill with your Freedom Flex, and you get coverage against covered theft or damage for phones listed on that bill. The coverage provides up to $800 per claim and $1,000 per 12-month period, with a maximum of two claims per year. There's a $50 deductible per claim. This can be a huge money-saver compared to expensive phone insurance plans offered by carriers.

Purchase Protection: Covers your eligible new purchases against damage or theft for 120 days from the date of purchase (Note: 90 days for New York residents). Coverage is limited to $500 per claim. This adds a layer of security when buying new items.

Extended Warranty Protection: This benefit extends the time period of an eligible U.S. manufacturer's warranty by an additional year, provided the original warranty is three years or less. It's great protection against potential repair costs after the manufacturer's coverage ends.

Trip Cancellation/Interruption Insurance: If your trip is canceled or cut short due to covered reasons like sickness, severe weather, or other specific situations, you can be reimbursed for prepaid, non-refundable passenger fares. Coverage is up to $1,500 per covered traveler and $6,000 per trip. This is a valuable safety net for non-refundable travel plans, often missing on no-fee cards.

Auto Rental Collision Damage Waiver (CDW): When you rent a car, decline the rental company's collision damage waiver (CDW or LDW) and pay for the entire rental with your Freedom Flex. This benefit provides reimbursement for theft and collision damage for most rental vehicles. Importantly, within the U.S., this coverage is typically secondary, meaning it kicks in after your personal auto insurance. Outside the U.S., it may function as primary coverage. Always verify coverage details for your specific rental situation.

Other Noteworthy Benefits: The card also includes standard protections like Zero Liability Protection for unauthorized charges, Fraud Alerts , access to Chase Offers for extra discounts at select retailers , and Travel and Emergency Assistance Services (referral service, costs of services are your responsibility). There is also a quarterly Doordash credit.

Here’s a quick summary of these valuable protections:

It's also worth noting that the Chase Freedom Flex is issued as a World Elite Mastercard. This is different from the original Chase Freedom (which was a Visa) and the current Freedom Unlimited (also a Visa). Being a World Elite Mastercard grants access to certain benefits provided by Mastercard network, potentially including the cell phone protection mentioned earlier and sometimes perks like Lyft credits or ShopRunner memberships, adding another layer of value beyond Chase's own offerings.

The Fine Print: Rates, Fees, and Bonus Details

No credit card review is complete without looking at the costs and key terms. Here’s what you need to know about the Freedom Flex:

Annual Fee: $0. This is a major plus, making all the rewards and benefits pure upside.

Welcome Bonus:

Standard Offer: As mentioned, the typical offer is Earn a $200 bonus after spending $500 on purchases in the first 3 months from account opening. This is a relatively low spending requirement for a solid bonus.

Eligibility: Be aware of Chase's typical restriction: You likely won't be eligible for the bonus if you currently have this card or have received a new cardmember bonus for this specific card within the past 24 months.

Introductory APR:

Offer: The card comes with a 0% introductory APR for 15 months from account opening on both purchases and balance transfers.

Value: This is a generous intro period for a rewards card. It gives you over a year to pay off large purchases interest-free or to tackle high-interest debt transferred from other cards. Chase seems to use this feature strategically not just for debt consolidation but also to encourage initial spending (helping you hit the welcome bonus) by removing the immediate interest burden.

Ongoing APR:

Rates: After the 15-month intro period ends, a variable Annual Percentage Rate (APR) will apply. This rate depends on your creditworthiness and prevailing market rates, typically ranging from 18.99% to 29.99%(check current terms for specifics). As always with credit cards, it's best to pay your balance in full each month to avoid interest charges.

Key Fees:

Balance Transfer Fee: While the intro APR on balance transfers is 0%, a fee applies to each transfer. This is typically either $5 or 5% of the amount of each transfer, whichever is greater (confirm specific terms when applying). This fee is charged upfront when the transfer posts.

Foreign Transaction Fee: As discussed earlier, expect a foreign transaction fee, likely 3% of each transaction made outside the United States. This makes it costly for international travel or online purchases from foreign merchants.

Late Payment Fee: Standard late payment fees apply (potentially waived for the first occurrence, but check terms). Unlike some cards, the Freedom Flex documentation reviewed doesn't explicitly mention a separate Penalty APR that kicks in after late payments, but late fees themselves can be costly.

How Freedom Flex Compares to the Competition

The no-annual-fee rewards card space is crowded. How does the Freedom Flex stack up against some popular alternatives?

vs. Chase Freedom Unlimited

The Showdown: These sibling cards share the $0 annual fee, 5% on Chase Travel, and 3% on Dining/Drugstores. The core difference lies in the primary earning structure: Flex offers the 5% rotating categories (requiring activation, $1500 quarterly cap) plus a 1% base rate. Unlimited skips the rotating categories but offers a higher 1.5% cash back on all other non-bonus purchases.

Your Choice: Go with Freedom Flex if you're an optimizer willing to track and activate categories for the higher 5% potential. Choose Freedom Unlimited if you value simplicity and want a better guaranteed return on your general spending. Many savvy users actually carry both to maximize earnings across all types of spending.

vs. Discover it Cash Back

Similar Ground: Both cards boast a $0 annual fee and the signature 5% cash back on rotating quarterly categories (up to $1,500 spend per quarter, activation required).

Key Differences: Discover's standout feature is its Cashback Match welcome offer, where they match all the cash back earned in the first year, effectively doubling your rewards. Freedom Flex earns Ultimate Rewards points, offering higher potential value through transfers. Discover's 5% bonus might not apply retroactively if you activate late , unlike Chase's. Freedom Flex has stronger fixed bonus categories (3% Dining/Drugstores). They also operate on different networks (Mastercard vs. Discover).

Your Choice: Discover it Cash Back is compelling for its potentially massive first-year bonus via Cashback Match. Freedom Flex wins for long-term value within the Chase ecosystem and better ongoing fixed rewards.

vs. Citi Custom Cash Card

Similar Goals, Different Paths: Both are $0 annual fee cards aiming for 5% cash back.

Key Differences: The Custom Cash automatically gives 5% cash back on your top eligible spending category each billing cycle, up to a $500 spending cap per cycle (then 1%). No activation is needed. Freedom Flex uses quarterly categories that require activation, but has a higher $1,500 quarterly cap. Custom Cash's eligible 5% categories are fixed (restaurants, gas, groceries, etc.), while Freedom Flex's rotate. Flex offers better fixed 3% categories (Dining/Drugstores). Custom Cash earns Citi ThankYou points; Freedom Flex earns Chase Ultimate Rewards points.

Your Choice: Citi Custom Cash offers superior simplicity – it adapts to your spending automatically each month (within its list of categories). Freedom Flex offers a higher potential quarterly earning cap in its bonus categories and integrates into the more versatile Chase Ultimate Rewards ecosystem.

Weighing the Pros and Cons

Let's boil it down. What are the biggest advantages and disadvantages of the Chase Freedom Flex?

Pros:

High Earning Potential: Combination of 5% rotating categories, 5% on Chase Travel, and 3% on dining and drugstores is hard to beat for a no-fee card.

$0 Annual Fee: Keeps costs down and makes rewards pure profit.

Attainable Welcome Bonus: $200 bonus for just $500 spend is excellent value.

Strong Cardholder Perks: Cell phone protection, purchase protection, extended warranty, and trip cancellation/interruption insurance are exceptionally valuable for a no-annual-fee card.

Generous Intro APR: 0% for 15 months on both purchases and balance transfers offers flexibility.

Ultimate Rewards Flexibility: Redeem for simple cash back or pool points with premium Chase cards for potentially much higher travel value.

World Elite Mastercard Benefits: Access to additional perks beyond Chase's standard offerings.

Cons:

Quarterly Activation Required: You must remember to activate the 5% categories each quarter.

Quarterly Spending Cap: The 5% rate is limited to $1,500 in spending per quarter.

Foreign Transaction Fee: Likely 3% fee makes it unsuitable for international spending.

Maximum Travel Value Requires Pairing: To get the best travel redemptions (portal bonus, transfer partners), you need to pair it with a premium Chase card that carries an annual fee.

Category Relevance Varies: The rotating 5% categories might not always align perfectly with your spending habits.

Subject to Chase 5/24 Rule: Getting this card uses one of your valuable 5/24 slots. Pro Tip: You can avoid using a 5/24 slot by product changing another card to this card, such as downgrading the Chase Sapphire Preferred to a Freedom Flex.

Is the Chase Freedom Flex a Keeper? Here’s My Take:

So, what's the final word on the Chase Freedom Flex? This card is a standout performer in the no-annual-fee category, offering a potent mix of high rewards potential and genuinely valuable benefits. The 5% rotating categories, combined with solid 3% earnings on dining and drugstores and 5% on Chase Travel, create a strong earning proposition. Add in perks like cell phone protection and trip cancellation insurance, and it punches well above its $0 annual fee weight class.

The main "catch" is the requirement to actively manage the card by activating the 5% categories each quarter, but that’s really not a big deal at all.

As a Standalone Card: If you're looking for a single, no-fee card, the Freedom Flex is an excellent choice, provided your spending aligns reasonably well with the bonus categories and you're diligent about activation. The cash back earned is solid, and the built-in protections add significant real-world value.

As Part of a Chase Strategy: If you're building an Ultimate Rewards strategy with cards like the Sapphire Preferred or Reserve, the Freedom Flex becomes a great addition to your wallet. It becomes your primary tool for earning 5x points in categories where your premium card might only earn 1x. Pooling these points unlocks the door to high-value flight and hotel redemptions via transfer partners, dramatically increasing your travel potential.

Ultimately, the Chase Freedom Flex is more than just a cash back card; it's a strategic asset. Whether you're just dipping your toes into the world of rewards or you're a seasoned pro looking to optimize your Ultimate Rewards earnings, the Freedom Flex delivers compelling value. You just need to be willing to play the quarterly activation game. For a card with no annual fee, the potential return is simply outstanding.

This card is definitely a keeper card for me. I make sure to max out the quarterly bonuses the majority of the time, especially if the categories are valuable for me, like grocery, paypal, and gas stations. I actually have a couple of these cards through product changes, so I can get up to 15,000 Ultimate Rewards points per quarter.

If you're interested in adding the Chase Freedom Flex to your wallet, you can learn more and apply here through my referral link. I will earn a small commission at no cost to you.

Looking for more ways to boost your travel rewards? Check out our guides to the Chase Sapphire Preferred, understanding the Chase 5/24 rule, and our comparison review of the Chase Freedom Flex vs the Freedom Unlimited.