Chase Freedom Unlimited Review: Is This Top No-Fee Credit Card Right for You?

The Chase Freedom Unlimited consistently ranks among the most popular no-annual-fee credit cards, and for good reason. It offers a compelling blend of straightforward cash back rewards on every purchases, boosted earnings in common spending categories, a valuable introductory APR offer, and solid cardholder protections. This versatility makes it appealing to both credit card beginners seeking their first rewards card and seasoned points enthusiasts looking to maximize their earnings within the Chase ecosystem.

But is it the right card for your wallet? This comprehensive review dives deep into the Chase Freedom Unlimited, analyzing its rewards structure, redemption strategies, benefits, fees, and how it stacks up against key competitors. We'll explore who stands to benefit most from this card and help you decide if it aligns with your spending habits and financial goals. Plus, we'll touch on the current welcome bonus available to new cardmembers.

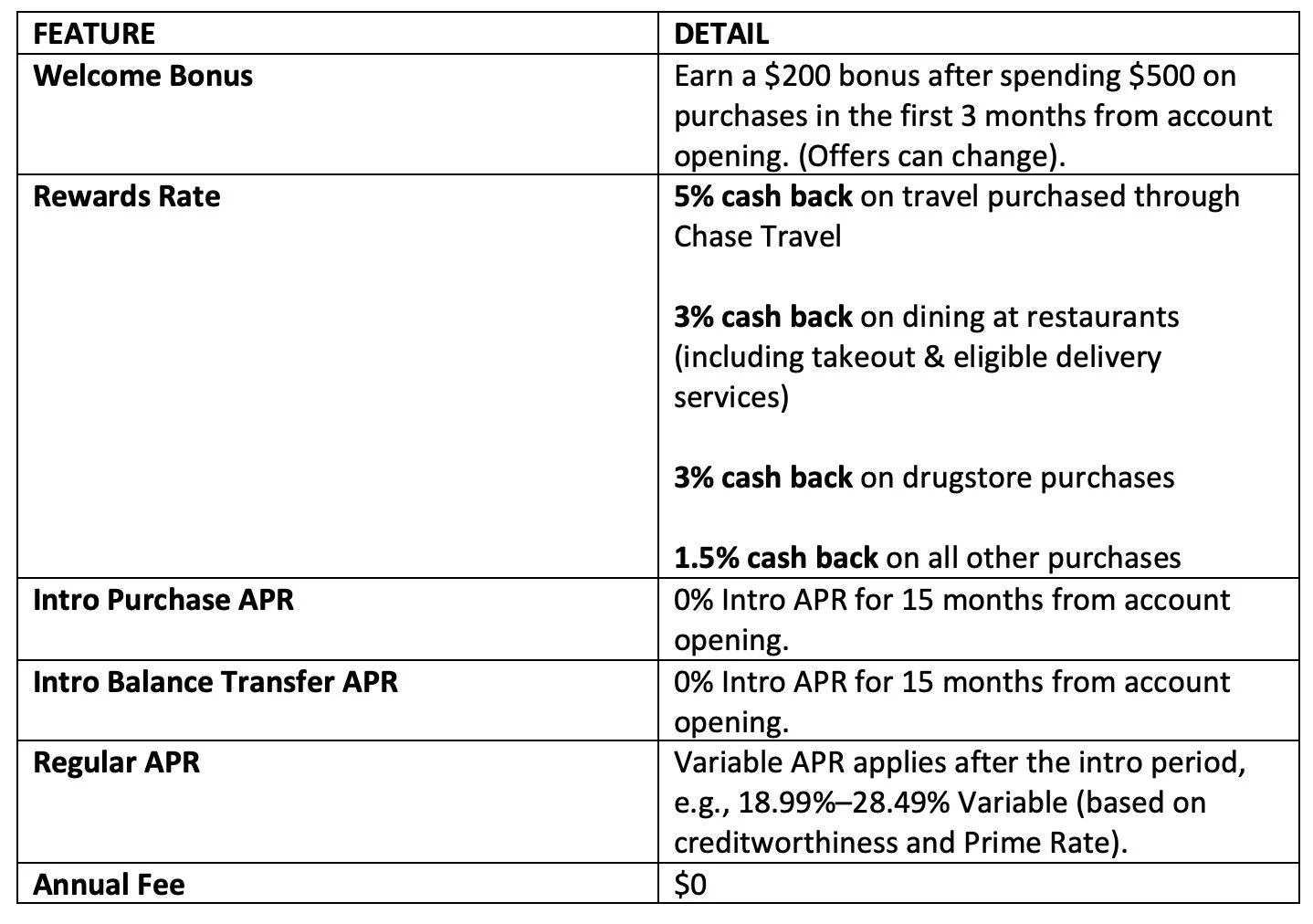

Chase Freedom Unlimited: At a Glance

Before we delve into the details, here's a quick overview of the Chase Freedom Unlimited's core features. This table provides a snapshot for easy comparison:

This combination of features – no annual fee, bonus categories on common spending, an elevated base earning rate, and an introductory APR period – forms the foundation of the card's broad appeal. It attempts to be a multi-purpose tool, catering to different needs simultaneously.

Earning Rewards with Chase Freedom Unlimited

The Chase Freedom Unlimited offers a multi-tiered rewards structure designed to reward both specific types of spending and general purchases.

Understanding the Tiered Rewards Structure

Cardholders earn cash back at the following rates :

5% cash back on travel purchased through Chase Travel.

3% cash back on dining at restaurants, including takeout and eligible delivery services.

3% cash back on drugstore purchases.

1.5% cash back on all other purchases.

It's important to note that the "cash back" is technically earned as Chase Ultimate Rewards points, where each point is worth 1 cent when redeemed for cash back. The 1.5% cash back on all other purchases is a key feature, offering a 50% higher return than standard 1% cash back cards on non-bonus spending. This makes it a strong "catch-all" card for expenses that don't fall into typical bonus categories. The 5% rate on travel booked through Chase Travel provides a strong incentive to use Chase's own booking platform, potentially locking users into the Chase ecosystem for their travel needs. This structure aims to reward common spending patterns (dining, drugstores) while ensuring solid returns on everything else.

Additionally, Chase sometimes offers temporary promotions. For instance, past offers included 5% cash back on Lyft rides through specific dates. Always check the current card details for any active limited-time offers.

The Welcome Bonus Explained

Currently, new Chase Freedom Unlimited cardholders can earn a $200 bonus after spending just $500 on purchases within the first 3 months of account opening.

This welcome offer stands out for its accessibility. Many rewards cards require spending $3,000, $4,000, or even more to earn their bonuses. The relatively low $500 spending threshold makes the Freedom Unlimited's bonus achievable for a wider range of applicants, including students, those new to credit, or individuals with more modest spending patterns.This approach likely reflects Chase's strategy to attract customers early in their credit journey, potentially fostering loyalty and encouraging future upgrades to premium cards. While welcome offers can change over time – past promotions have included first-year cash back matches – the current $200 bonus for $500 spend is straightforward and valuable.

Leveraging Chase Offers

Beyond the standard rewards structure, cardholders can access Chase Offers. These are targeted deals available through the Chase website or mobile app, providing extra statement credits or bonus cash back at specific retailers. Examples from past offers include extra earnings at places like Kroger, Little Caesars, or OfficeMax.

These offers require manual activation and vary from person to person. However, actively checking and utilizing relevant Chase Offers can provide an additional layer of savings or rewards on top of the card's regular earning rates. This feature encourages users to engage regularly with Chase's digital platforms and can make the card more rewarding than its base structure suggests, particularly for those who take the time to activate relevant deals.

Redeeming Your Chase Ultimate Rewards Points

While often marketed as a cash-back card, the Chase Freedom Unlimited actually earns points within the flexible Chase Ultimate Rewards program. Understanding how to redeem these points is key to maximizing the card's value.

Redemption Options and Point Values

For holders of only the Chase Freedom Unlimited, points typically offer the following redemption values :

Cash Back: Redeem points for statement credits or direct deposits into eligible U.S. bank accounts at a value of 1 cent per point. There's no minimum redemption amount for cash back.

Travel via Chase Travel: Book flights, hotels, car rentals, and more through the Chase Travel portal at a value of 1 cent per point.

Gift Cards: Redeem points for gift cards to various retailers, usually at 1 cent per point. Occasionally, Chase offers gift cards at a discount, increasing the value slightly.

Pay with Points (Amazon/PayPal): Use points directly for purchases on Amazon.com or via PayPal. This option generally yields a lower value (around 0.8 cents per point on Amazon) and is typically not recommended for maximizing value.

Importantly, Chase Ultimate Rewards points earned with the Freedom Unlimited do not expire as long as the credit card account remains open and in good standing.

On its own, the card functions as a straightforward cash-back card offering standard 1 cent-per-point redemptions. The fact that it earns points, however, is a deliberate design that enables more advanced redemption strategies when combined with other Chase cards.

Maximizing Value: The Chase Trifecta Advantage

The true potential of the points earned with the Chase Freedom Unlimited is unlocked when it's paired with a premium Chase card that also earns Ultimate Rewards points. This strategy is often referred to as the "Chase Trifecta". The premium cards that enable this are typically the Chase Sapphire Preferred Card, Chase Sapphire Reserve, or the Ink Business Preferred Credit Card.

Combining points from the Freedom Unlimited with one of these premium cards unlocks two significant advantages :

Increased Value in the Chase Travel Portal: Instead of the standard 1 cent per point, points pooled to a premium card account get a boost when redeemed for travel through the Chase portal:

1.25 cents per point with Chase Sapphire Preferred or Ink Business Preferred.

1.5 cents per point with Chase Sapphire Reserve. This represents a 25% to 50% increase in value for travel redemptions booked via Chase.

Access to Airline and Hotel Transfer Partners: This is often the most lucrative redemption pathway. Pooled points can be transferred, typically at a 1:1 ratio, to various loyalty programs, including :

Airlines: United MileagePlus, Southwest Rapid Rewards, British Airways Executive Club, Air France-KLM Flying Blue, Singapore Airlines KrisFlyer, Air Canada Aeroplan, and more.

Hotels: World of Hyatt, Marriott Bonvoy, IHG Rewards.

Transferring points to partners, particularly for premium cabin flights or high-value hotel stays, can yield significantly more than 1 cent per point. Points valuation experts often estimate the value at over 2 cents per point when transferred strategically. World of Hyatt is frequently cited as a particularly high-value transfer partner, allowing for luxury stays or efficient redemptions at lower-category properties.

This ecosystem strategy positions the Chase Freedom Unlimited as more than just a cash-back card; it becomes a crucial points-earning engine within a broader rewards strategy. Its $0 annual fee makes it an ideal long-term card for accumulating points through its bonus categories and 1.5% base rate, which then gain substantial value when leveraged through a paired premium card.

Key Cardholder Benefits and Protections

Beyond its rewards program, the Chase Freedom Unlimited offers several valuable benefits, especially notable for a card with no annual fee.

The Value of No Annual Fee

The most fundamental benefit is its $0 annual fee. This removes any pressure to spend a certain amount to "break even" on the card's cost. It makes the card accessible for beginners and allows users to keep the card open long-term at no cost, which can positively impact their credit history length, a factor in credit scoring. For those employing the Chase Trifecta strategy, the $0 fee ensures the Freedom Unlimited can serve as a cost-effective points-earning tool without adding to the annual fee burden of their premium cards.

Introductory APR Offer

The card typically offers a 0% introductory APR for 15 months from account opening on both new purchases and balance transfers. After the introductory period ends, a variable APR applies. This feature provides significant flexibility, allowing cardholders to finance a large purchase over time or transfer a balance from a high-interest card and pay it down without accruing interest during the promotional period. It's important to remember that a balance transfer fee applies to transferred balances. Offering a lengthy 0% intro APR on both purchases and balance transfers, alongside its rewards, makes the card exceptionally versatile compared to many competitors that might only offer one or the other, or have shorter intro periods.

Shopping and Travel Protections

The Chase Freedom Unlimited includes a suite of protections often found on cards with annual fees. Always refer to the official Guide to Benefits for full terms, conditions, and exclusions. Key protections include:

Purchase Protection: Covers eligible new purchases against damage or theft for 120 days from the date of purchase (90 days for New York residents), up to $500 per claim.

Extended Warranty Protection: Extends the manufacturer's U.S. warranty by an additional year on eligible warranties of three years or less.

Trip Cancellation/Interruption Insurance: Provides reimbursement up to $1,500 per person and $6,000 per trip for pre-paid, non-refundable passenger fares if your trip is canceled or cut short due to covered situations like sickness or severe weather.

Auto Rental Collision Damage Waiver (CDW): Offers reimbursement for theft or collision damage for most rental vehicles when you decline the rental company's CDW and pay for the entire rental with your card. This coverage is secondary to your personal auto insurance when renting within the U.S..

Travel and Emergency Assistance Services: Can provide referrals for medical or legal services while traveling (cardholder is responsible for the cost of services obtained).

Fraud Protection: Includes 24/7 fraud monitoring and $0 liability for unauthorized transactions.

The inclusion of these travel and purchase protections adds significant tangible value beyond rewards points, offering peace of mind without requiring an annual fee.

Understanding the Fees

While the Chase Freedom Unlimited boasts a $0 annual fee, potential applicants should be aware of other fees:

Annual Fee: $0.

Balance Transfer Fee: A fee applies to balance transfers, even during the 0% intro APR period. The structure is typically either $5 or 5% of the amount of each transfer, whichever is greater. Always check the official Pricing & Terms document for the current structure.

Foreign Transaction Fee: 3% of the amount of each transaction conducted in U.S. dollars outside the United States or in a foreign currency. This is a significant drawback for international travel.

Late Payment Fee: Up to $40.

Returned Payment Fee: Up to $40.

Cash Advance Fee: Either $10 or 5% of the amount of each transaction, whichever is greater.

The most notable fee for many users is the 3% foreign transaction fee. This effectively negates much of the rewards earned on purchases made abroad and positions the card primarily for domestic use. It also subtly encourages users planning international travel to consider Chase's premium cards, like the Sapphire Preferred or Sapphire Reserve, which do not charge this fee.

Chase Freedom Unlimited vs. The Competition

How does the Chase Freedom Unlimited compare to other popular no-annual-fee cash back cards?

Chase Freedom Unlimited vs. Chase Freedom Flex

The primary difference lies in how they reward spending outside of the shared 5% Chase Travel, 3% dining, and 3% drugstore categories.

Freedom Unlimited: Offers a simpler, consistent 1.5% cash back on all other purchases.

Freedom Flex: Offers 1% cash back on all other purchases BUT adds 5% cash back on rotating quarterly categories (up to $1,500 in combined purchases per quarter, activation required).

The Freedom Flex requires active management (tracking and activating categories) but offers the potential for higher rewards if spending aligns with the rotating categories. The Freedom Unlimited offers simplicity. Another minor difference is the payment network: Freedom Unlimited is a Visa, while Freedom Flex is a Mastercard, which grants the Flex access to Mastercard-specific perks like cell phone protection.

Chase Freedom Unlimited vs. Citi Double Cash Card

This comparison highlights the tiered rewards of the Chase Freedom Unlimited versus a high flat-rate card.

Citi Double Cash: Earns a straightforward 2% cash back on all purchases (1% when you buy, plus 1% as you pay).

Chase Freedom Unlimited: Earns 1.5% base, but 3% or 5% in its bonus categories.

The better card depends entirely on spending patterns. High spenders in non-bonus categories might favor the Double Cash's consistent 2%. Those who spend significantly on dining, drugstores, or through the Chase Travel portal can potentially earn more with the Freedom Unlimited. The Double Cash typically offers a longer intro APR period for balance transfers (18 months) but lacks one for purchases, whereas the Freedom Unlimited offers 15 months for both. Both have $0 annual fees and 3% foreign transaction fees. Point transfer potential exists for both, but requires pairing with specific premium cards from their respective issuers.

Chase Freedom Unlimited vs. Capital One Quicksilver Cash Rewards Credit Card

These cards share the same base earning rate but differ in bonus categories and travel usability.

Capital One Quicksilver: Earns a flat 1.5% cash back on all purchases and 5% on hotels and rental cars booked through Capital One Travel.

Chase Freedom Unlimited: Also earns 1.5% base, but adds 3% on dining/drugstores and 5% on broader travel categories via the Chase portal.

For domestic spending, the Freedom Unlimited generally offers higher earning potential due to its additional bonus categories. However, the Quicksilver's crucial advantage is its lack of foreign transaction fees, making it superior for international use. Both cards offer similar welcome bonuses (Freedom Unlimited often slightly higher) and intro APR periods. The choice hinges on whether a user prioritizes bonus category earnings (Freedom Unlimited) or international usability (Quicksilver).

Who Should Get the Chase Freedom Unlimited?

The Chase Freedom Unlimited caters to several distinct user profiles:

Credit Card Beginners: With a $0 annual fee, relatively easy-to-understand rewards (especially the 1.5% base), an attainable welcome bonus, and the chance to build a credit history with a major issuer like Chase, it's an excellent starter card.

Everyday Spenders: Individuals whose regular spending includes dining out, takeout/delivery, and drugstore purchases will benefit from the 3% bonus categories. The 1.5% rate on all other spending provides solid value for general purchases.

Chase Loyalists & "Trifecta" Builders: For those already invested in the Chase Ultimate Rewards ecosystem or planning to be, the Freedom Unlimited is almost essential. It serves as a high-earning card for non-bonus spend and specific categories, with points that become significantly more valuable when pooled with a Sapphire Preferred, Sapphire Reserve, or Ink Business Preferred card for travel redemptions.

Those Needing Financing/Debt Consolidation: The 15-month 0% intro APR on both purchases and balance transfers makes it a strong option for financing large upcoming expenses or paying down existing high-interest credit card debt interest-free for over a year.

Potential Drawbacks to Consider

While versatile, the Chase Freedom Unlimited isn't without its downsides:

Foreign Transaction Fee: The 3% fee on international purchases makes it a poor choice for use outside the U.S.

Base Earning Rate: While 1.5% is better than 1%, flat 2% cash back cards like the Citi Double Cash Card offer higher rewards on general spending.

Pairing Required for Maximum Value: To unlock the highest potential value through travel portal bonuses or transfer partners, you need to pair it with a premium Chase card that carries an annual fee. Standalone redemption values are standard.

Chase 5/24 Rule: A significant hurdle for many rewards card enthusiasts. If you've opened 5 or more personal credit cards from any bank in the last 24 months, Chase will likely deny your application for the Freedom Unlimited. This is why many points and miles enthusiasts prefer to product change into this product vs applying for it outright.

Reward Structure Complexity: The multiple earning tiers (5%/3%/1.5%) require more attention than a simple flat-rate card, although less than managing rotating categories.

Acknowledging these limitations provides a balanced view. The card's suitability depends on weighing these drawbacks against its considerable strengths based on individual needs and priorities.

Final Thoughts: Is the Chase Freedom Unlimited Worth It?

Ultimately, the Chase Freedom Unlimited offers a powerful and versatile package for a $0 annual fee. Its blend of solid rewards, valuable benefits, and strategic importance within the Chase ecosystem makes it a card that deserves consideration for a wide range of consumers. Travel hackers may decide that it is more worth it to product change into this card vs apply for it outright if they are concerned with staying under Chase’s 5/24 rule.

✅ If you would like to apply for the Chase Freedom Unlimited, you can do that HERE through my referral link.

✅ You can read my article comparing the Chase Freedom Flex with the Chase Freedom Unlimited to find out which card is best to pair with your Sapphire

✅ Check out the Chase Sapphire Preferred - Full Benefits Breakdown next

✅ Want an in-depth analysis of the Chase Freedom Flex? Check it out here - Chase Freedom Flex Review