Credit Card-Linked Offers: How I Get Secret Discounts at Stores I Already Shop At

What if I told you that you might be leaving money on the table every single time you shop?

I’m talking about extra discounts and statement credits at places you already spend money; your favorite restaurants, online stores, gas stations, even your grocery store.

I’m not talking about clipping coupons or hunting for promo codes, although I can totally appreciate that because I’m a fan of extreme couponing and deal-churning. I can’t remember the last time I paid for toothpaste! No, I’m talking about a powerful and very lucrative feature that’s built right into the credit cards you already have in your wallet.

We're diving into the world of credit card-linked offers. I’ll show you what they are, how they work, and how you can use them to effortlessly save hundreds of dollars a year. Plus, I'll share a pro tip on how I automate the entire process so that I never miss a deal. Stick around till the end and you’ll learn how to maximize your points and cashback without even trying.

What Exactly Are Card-Linked Offers?

Think of a card-linked offer as a targeted, digital rebate that is tied directly to your credit card. Retailers, from big-box stores like Lowe's, to airlines like Southwest, partner with major banks like American Express, Chase, and Citi to offer you special deals. Their goal? To encourage you to shop with them instead of a competitor.

You might be wondering, "Why are companies just giving away money like this? It seems too good to be true."

It's actually one of the most brilliant forms of marketing out there, and it all comes down to solving a huge problem every business faces: getting the right customers in the door and encouraging them to spend money.

Let’s quickly break down the three main reasons why a retailer would pay to give you this discount.

It’s Targeted Advertising on Steroids. Think about traditional advertising like a billboard or a TV commercial. Retailers spend a fortune blasting a message out to millions of people, hoping it reaches the few who are actually interested. It's expensive and inefficient. But your credit card company knows your spending habits. They know if you frequently shop at pet stores, if you buy plane tickets, if you spend a lot on home improvement, or if you eat out three times a week. This data is pure gold for retailers. If a high-end luggage company wants to find new customers, who better to advertise to than people who have a history of buying plane tickets and booking hotels? By creating an Amex Offer, they can put a deal like "Spend $300, get $60 back" directly in front of a proven traveler. It cuts through the noise and targets only the most likely buyers.

It's a "Nudge" to Spend (and Spend More). These offers are designed to influence your behavior at the exact moment you're making a decision. Imagine you need new running shoes. You open your Chase Offers and see a deal for 10% back at Adidas. Even if you were considering other brands, that concrete saving might be the final nudge that makes you choose them over a competitor. The retailer just won your business. The offers also encourage you to increase your spending. An offer like "Spend $100, get $20 back" is psychologically brilliant. If your cart is at $85, you are highly motivated to find another $15 item just to trigger that discount. The retailer might be giving you a $20 rebate, but they just successfully turned an $85 sale into a $100 sale.

It’s Frictionless and Perfectly Trackable. From our perspective as shoppers, it’s incredibly easy. We just click a button online and then shop like normal. There are no paper coupons to forget or promo codes to type in. Because it's so easy, the chances of us actually using the offer are much higher. For the retailer, it’s a dream come true because they only pay for results. They aren't paying for "views" or "clicks" on a banner ad that might not lead to anything. They only pay the rebate when a customer actually walks in or checks out online and makes a purchase. They can track their return on investment perfectly.

Ultimately, it’s a win-win-win situation:

The Retailer gets a highly targeted, performance-based sale.

The Bank gets a fee from the retailer and, more importantly, keeps you loyal and engaged with their card.

We, the savvy consumers, get a discount on things we were often going to buy anyway.

It’s not a scam; it’s just a smarter way for everyone to get what they want.

The Best Part: Stacking Discounts

Here’s the absolute best part about card-linked offers: they are stackable. This means the discount you get is on top of the regular points or cashback you’re already earning on your card. So you could be earning your normal 3x points on dining, and then get an extra $10 back from a card-linked offer at that same restaurant.

You’ll see offers like these on a regular basis:

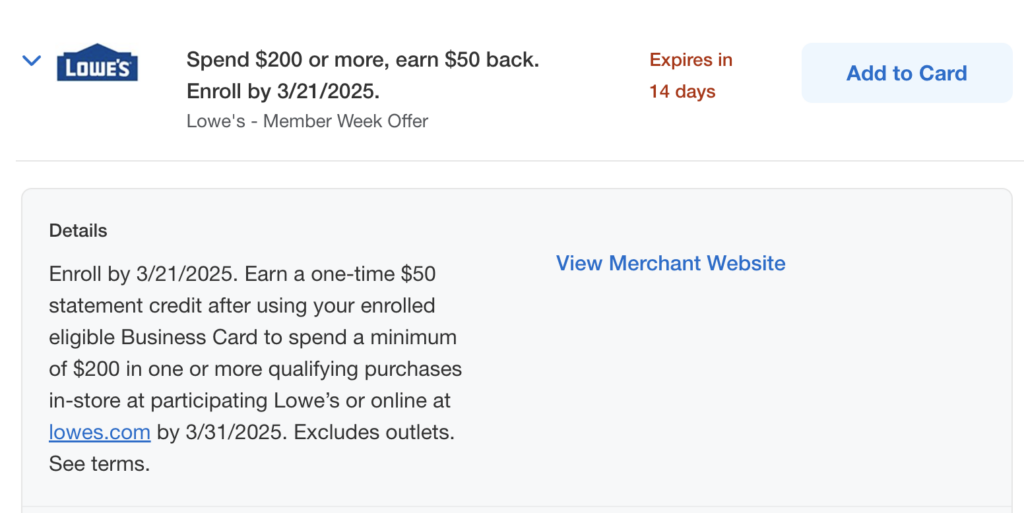

Spend $200 or more at Lowe’s, get $50 back.

Get 10% back on your purchase at Southwest Airlines (up to $40 back).

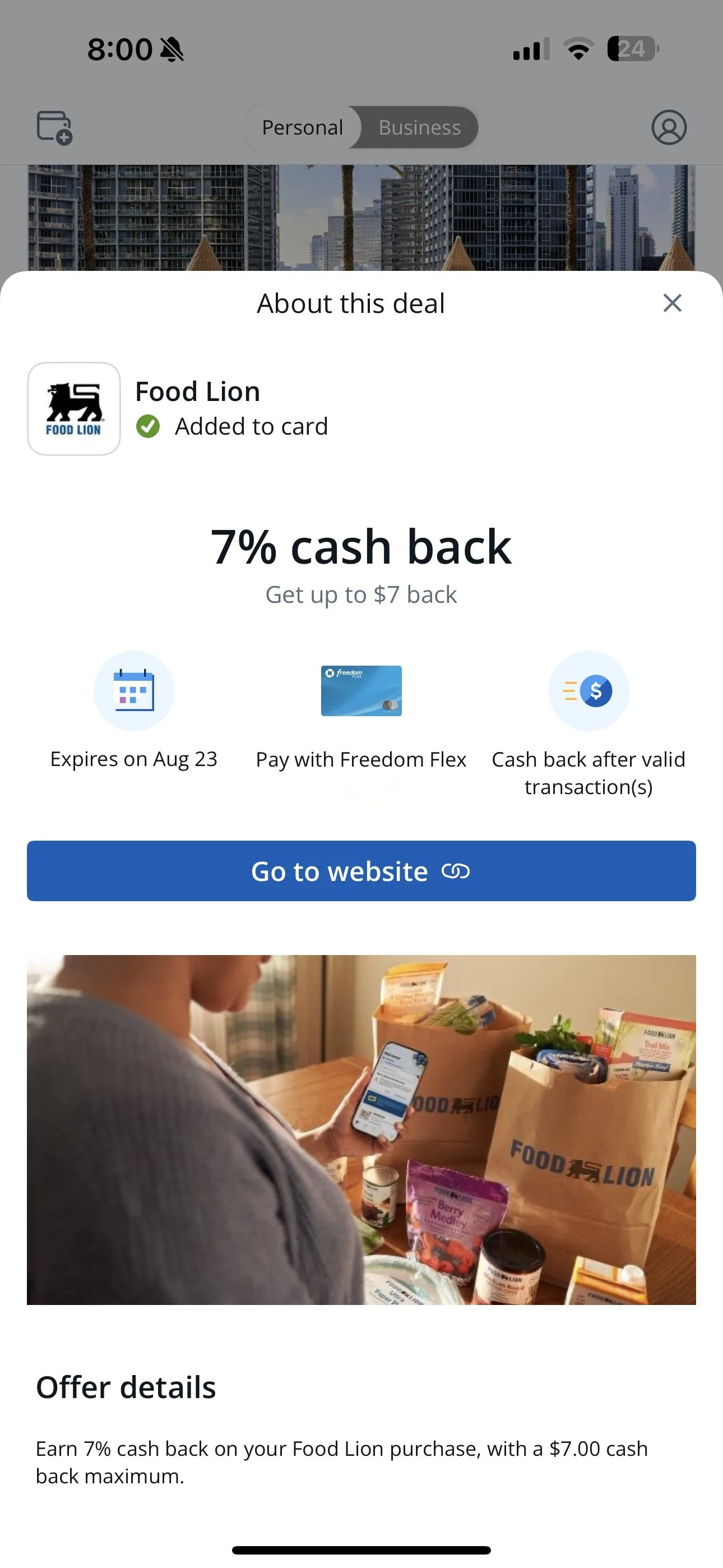

Earn 7% cash back on your Food Lion purchase (up to $7 back).

Spend $1000 or more at AirFrance.com or KLM.com and earn 20,000 Membership Rewards points.

This is truly free money, just waiting for you to claim it.

How to Find and Activate These Offers

You can easily find these offers in your bank’s mobile app. The biggest players in the game are American Express Offers, Chase Offers, Citi Merchant Offers, and Bank of America Offers. Other major banks like Capital One and US Bank also have their own versions.

The process to use them is simple, but it requires one crucial step: activation.

Log in to your bank's app or website and navigate to the "Offers" or "Deals" section.

Browse through the list of available deals for each of your cards.

When you see one you like, you have to click on it to "Add to Card" or "Activate." If you don't click that button, you will not get the discount.

Then, just use that exact credit card to make your purchase, and that’s it! The bank automatically tracks it, and you’ll see a statement credit or bonus points appear on your account a few days or weeks later.

My Secret Weapon: Automating the Process

Now, activating offers is easy. But remembering which offer is linked to which card is a different story. If you’re like me and you have multiple credit cards to maximize your rewards, who can remember which offer is added to which card? And who has the time to log into the Amex app, the Chase app, the Citi app, every single week, scroll through dozens of offers for each card, and add them one by one? You're bound to miss some great deals if you're doing it manually.

This is where I rely on a tool that has become essential to my points and miles strategy: CardPointers.

You may remember that I posted a full review video on the CardPointers app a while back, showing how it helps you know the best card to use for any purchase. But it has another feature that is an absolute game-changer for card-linked offers.

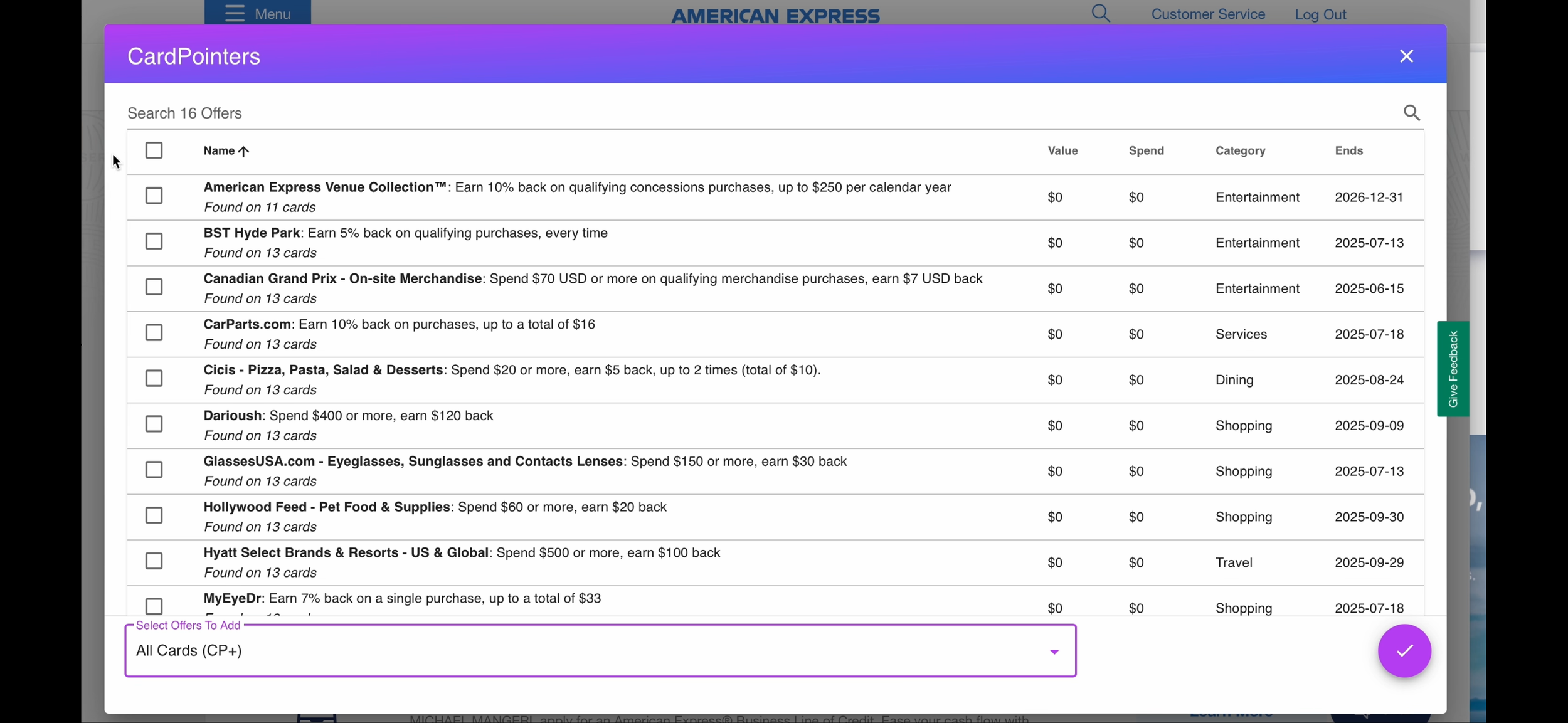

The CardPointers browser extension automatically syncs with your Amex, Chase, Citi, and Bank of America accounts and activates all of your card-linked offers for you.

Yes, you heard that right. It browses all those pages for you and clicks "Add to Card" on every single offer across all of your cards. This means you never have to worry about missing out on a deal because you forgot to log in and activate it. You can just spend as you normally would, and these savings will pop up on your statement as a pleasant surprise.

It completely solves the biggest pain point of using these offers. It also helps you stay organized because you can search for a retailer in the CardPointers app, and it will not only tell you which card gives you the most points or cashback for that purchase, but it will also pull up any card-linked offers that you have for that retailer.

The lifetime plan for this tool is actually very cheap and has saved me thousands of dollars since I’ve been using it. Sometimes you need to spend a little money to save a lot of money, and if you hold any cards with annual fees, then you likely already understand this principle.

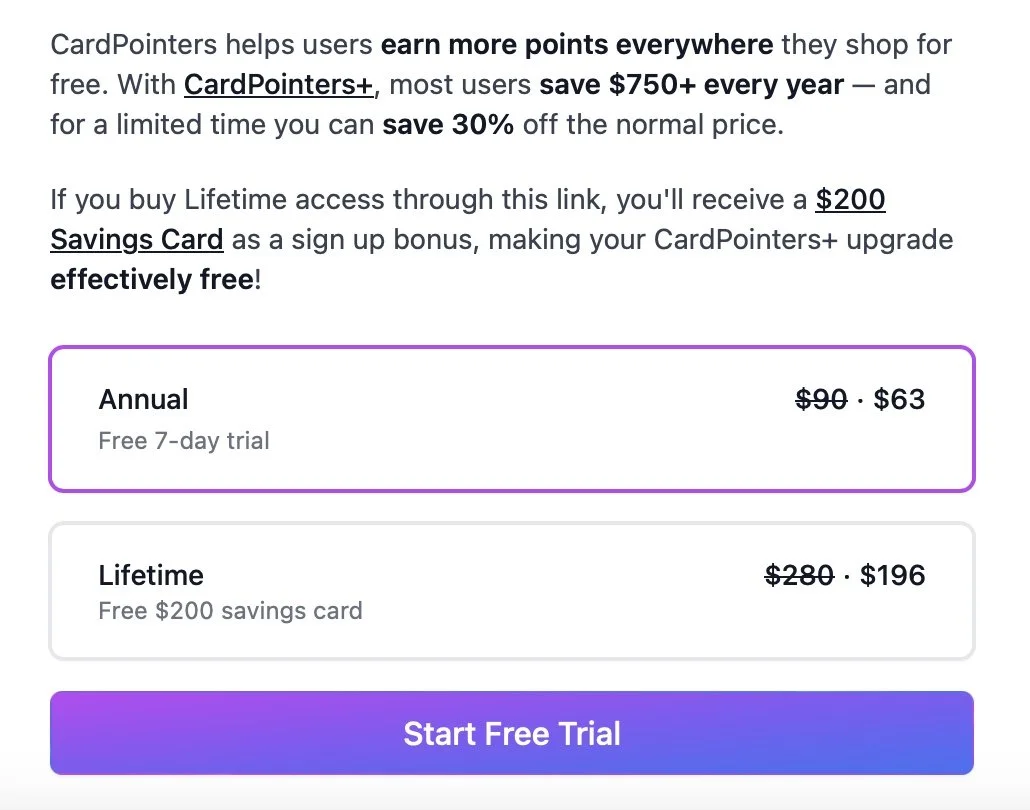

Because I think it’s such a valuable tool for our community, I reached out to the creator of CardPointers, and he was kind enough to offer a special discount just for the Miles with Mary community.

If you my link you will get 30% off your first CardPointers Pro membership, on both the annual plan or the lifetime plan. It’s an investment that I guarantee will pay for itself many times over in the savings you’ll get from offers you would have otherwise missed. Check out the link: www.cardpointers.com/mileswithmary

The Bottom Line: Start Saving Today

Card-linked offers are one of the easiest, most effortless ways to put money back in your pocket. It’s a benefit you’re entitled to just for having the card, but you have to take that first step to activate them.

Using a tool like CardPointers turns this from a chore you have to remember into an automatic function that’s always working for you and helping to keep you organized.

If you want to learn more, you can check out my video where I break down CardPointers into more detail and tell you exactly how it works to help you maximize your card-linked offers.